Executive summary

Carbon budget alignment: company by company

This new analysis provides a way of understanding whether the supply options of the largest publicly traded oil and gas producers are aligned with demand levels consistent with a 2 degree Celsius (2D) carbon budget. By allocating the carbon budget to potential oil and gas projects, through applying the economic logic of a carbon supply cost curve, it is possible to identify which companies have the highest exposure to potential capital expenditure (capex) to 2025. This report provides a snapshot of the potentially unneeded capex spend for 69 global oil and gas companies – highlighting for the first time, the wide-ranging degree of exposure amongst companies in the sector.

Excess capex

The analysis shows that:

- US$2.3trn – around one third – of potential capex to 2025 should not be deployed in a 2D scenario compared to business as usual expectations.

- Company level exposure varies from under 10% to over 60% when considering the largest 69 publicly traded companies.

- Around two thirds of the potential oil and gas production, which is surplus to requirements in a 2D scenario, is controlled by the private sector.

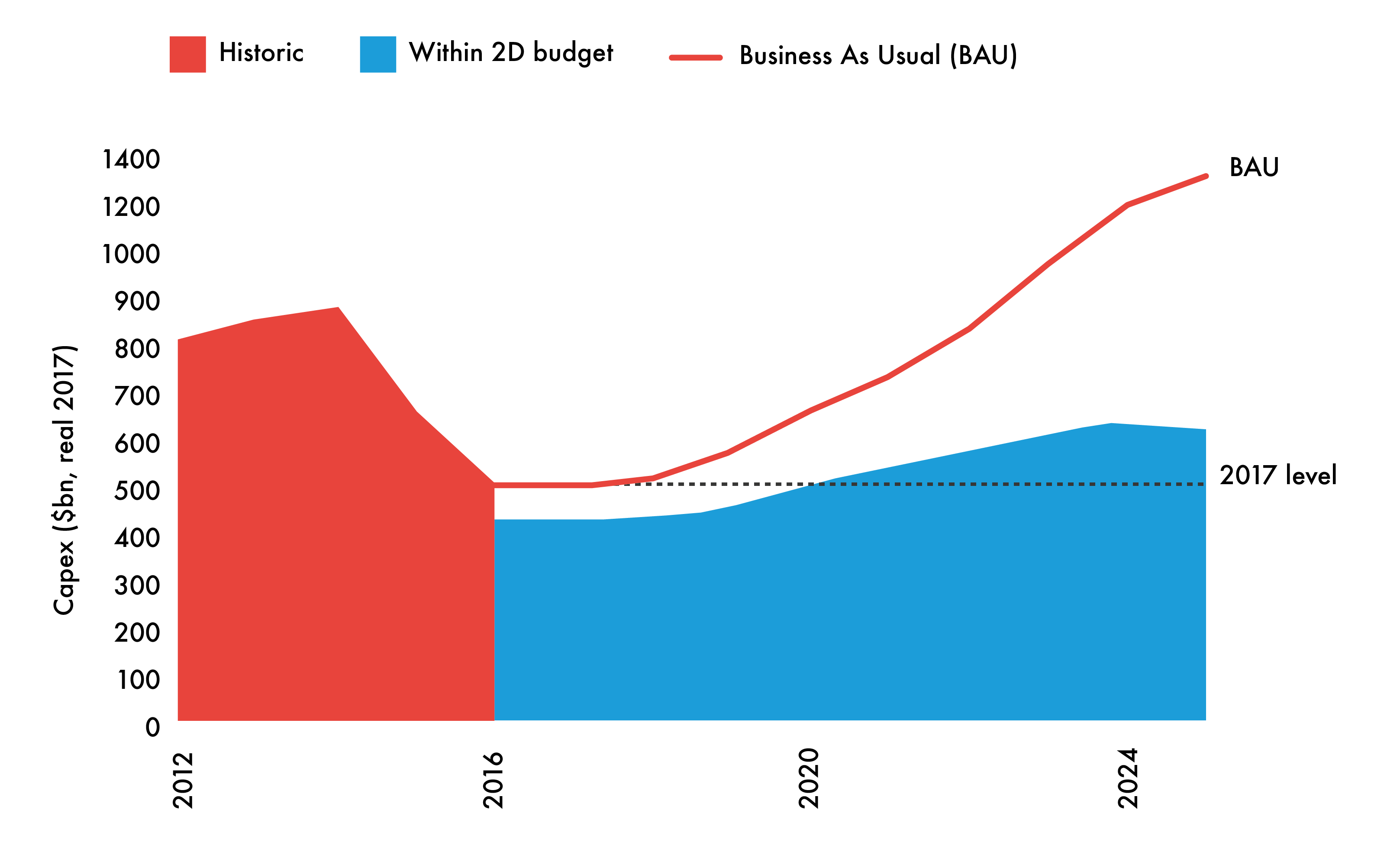

Projected capex under 2D scenario

Source: Rystad Energy, CTI analysis

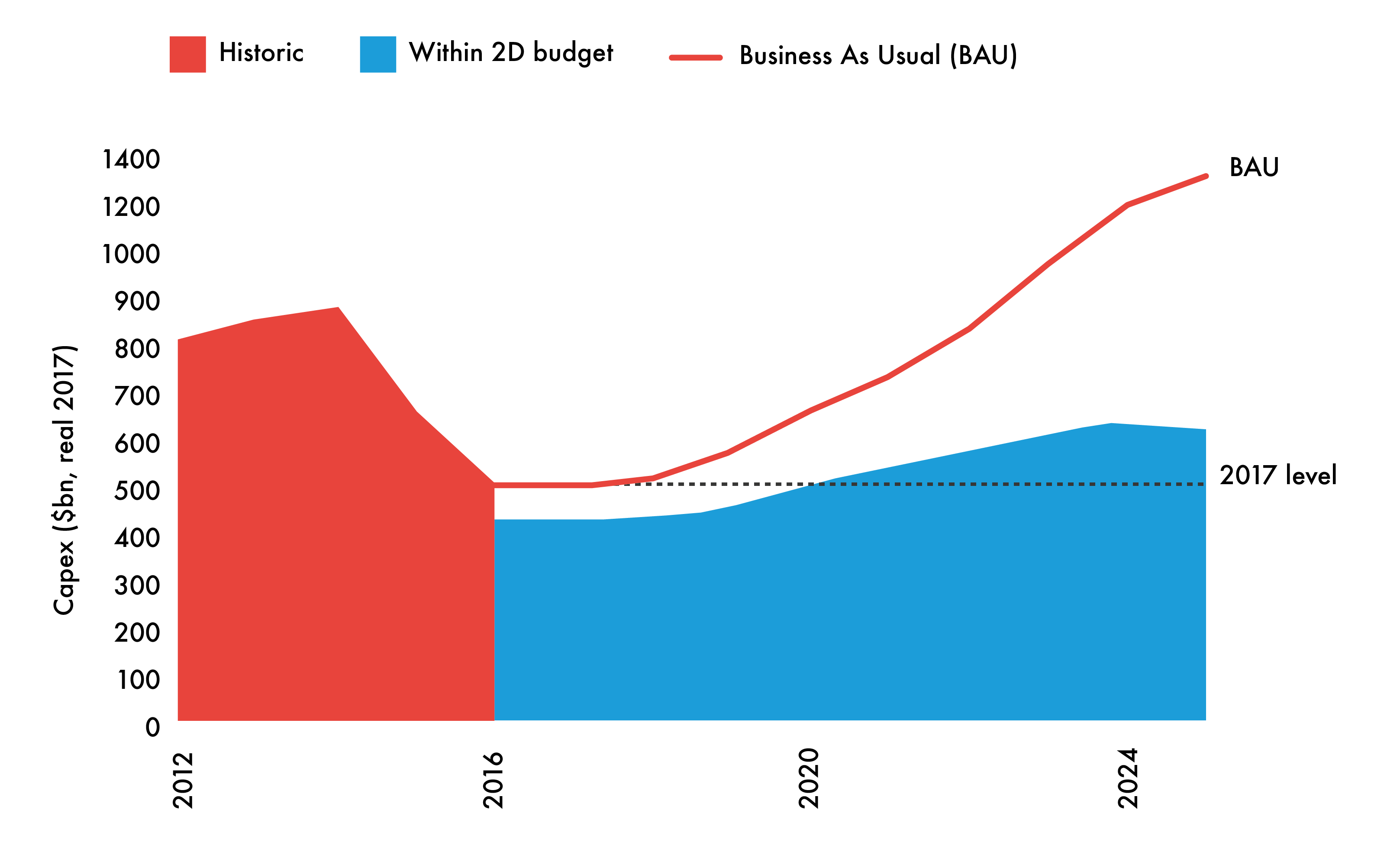

On the rebound?

Capital expenditure has dropped in recent years as a response to the lower oil price. In order to align with a 2D scenario, the level of capital deployment should not rebound from 2016 levels across the industry as a whole. Under a business as usual scenario, with rising prices, investment ramps up again. This would create financial exposure to projects not consistent with peaking emissions in the near future.

2D scenario

This analysis utilises the oil and gas demand levels indicated by the International Energy Agency’s (IEA) World Energy Outlook 2016 450 scenario as a proxy for a 2D scenario. For the period 2017-2035, this equates to a total carbon budget for oil and gas of 320Gt of CO2, split 59% for oil and 41% for gas. This is at the higher end of the range of carbon budgets that could be applied, as it only provides a 50% probability of a 2D outcome. If one were to try and align with limiting global warming to below 2D, or apply a higher likelihood of the outcome then this would provide an even tighter constraint on future oil and gas supply and demand.

Identifying the potential winners and losers

This analysis focuses on the metric: “percentage of potential capex outside 2D budget”. This can effectively give investors a sense of what proportion of the company’s investment plans may fail to deliver an acceptable return in the scenario of a world limited to 2°C global warming outcome (i.e. which project capex is within budget and which is "unneeded"). This can be interpreted in different ways according to investment strategies and policies. In terms of risk management, some investors may prefer a degree of optionality – but the higher the level of unneeded capex, the more growth strategies would have to be tempered. For investors seeking to align with a 2D scenario, it is clear that some companies are better positioned than others.

| Company | Country of headquarters | % of upstream capex outside 2D budget (% band) | 2017-2035 carbon budget (GtCO2) | Potential CO2 outside 2D carbon budget (GtCO2) |

| Southwestern Energy | United States | 60% - 70% | 1.0 | 0.6 |

| Apache | United States | 60% - 70% | 1.1 | 1.0 |

| Cabot Oil and Gas | United States | 50% - 60% | 0.6 | 0.4 |

| Energen | United States | 50% - 60% | 0.2 | 0.1 |

| Murphy Oil | United States | 50% - 60% | 0.4 | 0.3 |

| Concho Resources | United States | 50% - 60% | 0.4 | 0.3 |

| Imperial Oil (Public traded part) | Canada | 50% - 60% | 0.4 | 0.2 |

| Vermilion Energy | Canada | 50% - 60% | 0.1 | 0.1 |

| Oil Search | Papua New Guinea | 50% - 60% | 0.2 | 0.1 |

| Encana | Canada | 50% - 60% | 1.0 | 0.6 |

| Chesapeake | United States | 40% - 50% | 1.8 | 1.2 |

| Inpex | Japan | 40% - 50% | 1.4 | 0.3 |

| ExxonMobil | United States | 40% - 50% | 8.6 | 3.1 |

| Husky Energy | Canada | 40% - 50% | 0.9 | 0.3 |

| Woodside | Australia | 40% - 50% | 0.7 | 0.3 |

| Suncor Energy | Canada | 40% - 50% | 2.3 | 0.4 |

| EQT Corporation | United States | 30% - 40% | 1.2 | 0.4 |

| Devon Energy | United States | 30% - 40% | 1.6 | 0.5 |

| Chevron | United States | 30% - 40% | 6.4 | 2.0 |

| Eni | Italy | 30% - 40% | 4.6 | 1.1 |

| Shell | Netherlands | 30% - 40% | 9.9 | 2.7 |

| Galp Energia SA | Portugal | 30% - 40% | 0.3 | 0.1 |

| Canadian Natural Resources (CNRL) | Canada | 30% - 40% | 2.0 | 0.5 |

| Noble Energy | United States | 30% - 40% | 1.3 | 0.6 |

| Repsol | Spain | 30% - 40% | 1.8 | 0.3 |

| Newfield Exploration | United States | 30% - 40% | 0.4 | 0.2 |

| Total | France | 30% - 40% | 6.3 | 1.2 |

| Crescent Point Energy | Canada | 30% - 40% | 0.2 | 0.1 |

| Hess | United States | 30% - 40% | 0.8 | 0.2 |

| Origin Energy | Australia | 30% - 40% | 0.3 | 0.1 |

| Rosneft | Russia | 30% - 40% | 9.5 | 1.3 |

| Continental Resources | United States | 20% - 30% | 0.7 | 0.3 |

| Anadarko | United States | 20% - 30% | 2.5 | 0.6 |

| Cimarex Energy | United States | 20% - 30% | 0.7 | 0.1 |

| Occidental Petroleum | United States | 20% - 30% | 1.6 | 0.5 |

| BP | United Kingdom | 20% - 30% | 6.5 | 1.5 |

| Lukoil | Russia | 20% - 30% | 5.0 | 0.5 |

| PetroChina | China | 20% - 30% | 9.6 | 0.7 |

| ConocoPhillips | United States | 20% - 30% | 3.8 | 0.8 |

| EOG Resources | United States | 20% - 30% | 2.3 | 0.6 |

| CNOOC | China | 20% - 30% | 2.9 | 0.5 |

| Gazprom | Russia | 20% - 30% | 17.8 | 2.0 |

| Santos | Australia | 20% - 30% | 0.4 | 0.1 |

| Statoil | Norway | 20% - 30% | 4.3 | 0.6 |

| Rice Energy | United States | 20% - 30% | 0.7 | 0.1 |

| RSP Permian | United States | 10% - 20% | 0.4 | 0.1 |

| Marathon Oil | United States | 10% - 20% | 1.1 | 0.2 |

| OMV | Austria | 10% - 20% | 0.5 | 0.1 |

| QEP Resources | United States | 10% - 20% | 0.4 | 0.1 |

| Cenovus Energy | Canada | 10% - 20% | 0.9 | 0.1 |

| Tullow Oil | United Kingdom | 10% - 20% | 0.3 | 0.0 |

| Parsley Energy | United States | 10% - 20% | 0.2 | 0.0 |

| Ecopetrol | Colombia | 10% - 20% | 0.8 | 0.1 |

| Lundin Petroleum | Sweden | 10% - 20% | 0.3 | 0.0 |

| Sinopec | China | 10% - 20% | 2.3 | 0.2 |

| Pioneer Natural Resources | United States | 0% - 10% | 1.8 | 0.2 |

| Peyto | Canada | 0% - 10% | 0.3 | 0.1 |

| Petrobras | Brazil | 0% - 10% | 5.9 | 0.4 |

| Surgutneftegas | Russia | 0% - 10% | 2.0 | 0.0 |

| Tatneft | Russia | 0% - 10% | 1.1 | 0.0 |

| Range Resources | United States | 0% - 10% | 2.0 | 0.0 |

| Saudi Aramco | Saudi Arabia | 0% - 10% | 30.2 | 0.4 |

| Novatek | Russia | 0% - 10% | 2.8 | 0.1 |

| Arc Resources | Canada | 0% - 10% | 0.5 | 0.0 |

| Gulfport Energy | United States | 0% - 10% | 0.8 | 0.0 |

| Tourmaline Oil | Canada | 0% - 10% | 1.0 | 0.0 |

| Diamondback Energy | United States | 0% - 10% | 0.4 | 0.0 |

| Antero Resources | United States | 0% - 10% | 1.3 | 0.0 |

| Seven Generations Energy | Canada | 0% - 10% | 0.7 | 0.0 |

Source: Rystad Energy, CTI analysis

A moving feast

This analysis provides a snapshot of the industry at the start of 2017 using relative project economics to determine which projects are included in different scenarios. There has been significant movement in terms of both the overall cost curve, and the relative positions in the 18 months since the last Carbon Tracker review of the global oil and gas sector. This reflects overall downward pressure on costs in response to the oil price, as well as shifts by certain regions. The changing dynamics between OPEC producers and the US shale industry have provided a novel backdrop to this picture. Increased standardisation and efficiency of US shale operations have seen major cost declines, and resource expectations have been upgraded. The fall in oil price has also hit some hydrocarbon exporting nations hard, affecting foreign exchanges rates. This demonstrates why it is important for companies to provide regular information on how their strategy is adapting to the changing context, as well as aligning with a 2D scenario.

Private sector supply more exposed

Around two thirds of the potential oil and gas production which is surplus to requirements in a 2D scenario is controlled by the private sector, demonstrating how the risk is skewed towards listed companies rather than national oil companies. The significance of the large companies and the products they produce is also evident from the analysis. The carbon budget that the production of an oil major will use up to 2035 is equivalent to the recommended carbon budget for the whole of the UK for a similar period.

Increased transparency required

Oil and gas companies have options in terms of which new projects they plan to develop in the future. At present there is little transparency of these strategies, making it difficult for investors to understand and test the degree of alignment with a 2D scenario. Companies may have already decided to put a number of high cost projects on hold, but more can be done to tell this story to their shareholders.

ExxonMobil shareholders signal demand for scenario analysis

The energy transition is upon us, and across the financial system from pension funds to regulators, increasing scrutiny of the alignment of carbon intensive companies with a low carbon future is evident. The May 2017 shareholder resolution at ExxonMobil calling for management to produce a report detailing the implications of a 2D scenario for the company received 62% support. This, along with similar results at other oil and gas companies’ AGMs, signals that the majority of investors in the world’s biggest fossil fuel producers see value in having this information.

Taskforce on Climate-related Financial Disclosures (TCFD) provides reference point

The Financial Stability Board’s (FSB) TCFD recommendations recognise the value of 2D scenario analyses, and particularly highlight disclosure of 2D reference scenario tests as one of the key ways to improve and help standardise company reporting around future climate risks. While such tests are increasingly common amongst larger oil and gas companies, this research also proves that it is possible even for small organisations to produce an analysis of relative positioning under a 2D reference scenario. With a number of investment institutions and companies already committed to following the final recommendations, the impetus for those left to follow suit is clear.

Introduction

The speed and scale of the energy transition is becoming more obvious every day, causing more investors to accept the need to improve their strategies to be well positioned as structural changes in the energy and related sectors occur. Whilst full transformation may take time, unanticipated changes in the supply-demand relationship can have material impacts in the short term. The markets are showing that even relatively small shifts in market share, (e.g. US coal power generation), or market size, (e.g. global oil oversupply), can have material impacts on financial performance.

This research has been developed in response to investor demand for understanding company level exposure to the energy transition. Many large pension funds, insurance companies and asset managers are looking at climate risk with greater scrutiny, which is reflected the interest seen by both the UN-supported Principles for Responsible Investment (PRI) from its signatories and Carbon Tracker from the investors it works with.

Climate change momentum has led to a number of investor-led initiatives, including:

- Carbon Asset Risk and Aiming for A resolutions;

- the Montréal Carbon Pledge;

- the Portfolio Decarbonisation Coalition,

- the Transition Pathways Initiative.

The range of approaches reflects the different investment strategies and prevailing investment cultures on different continents.

The focus on transition risk has been crystallised by the FSB TCFD. The taskforce has outlined how scenario analysis is a useful tool for regulators, financial institutions and non-financial companies to understand energy transition risk, and the increasing expectations around disclosure of this analysis.

The recommendations of the taskforce will start to feed through to company disclosures, with several companies already committing to implementing them going forward. This analysis demonstrates how feasible it is to apply this kind of simple scenario analysis to produce decision useful information on the oil and gas sector, and reflects the kind of disclosure starting to be seen from leading companies.

In response to these developments, this new analysis has been developed to provide indicators of company exposure to the low-carbon transition. The approach of building up understanding of asset level data and integrating the relative economics of production options provides analysis which reflects how energy markets work, going beyond blanket approaches to allocating the carbon budget across an entire sector.

The numbers – focus on future production options

Since demonstrating the vast overhang of coal, oil and gas in the ground compared to a carbon budget to limit global warming to two degrees, Carbon Tracker has developed forward-looking indicators to understand the implications for individual companies. One of the most frequent reactions from investors is to ask who the winners and losers are under such a scenario. Whilst simple reserve and resources numbers across all fossil fuels answered the macro question of whether there was exposure to unburnable carbon, a more sophisticated approach looking at production profiles is required to differentiate at a company level.

Carbon supply cost curves

In order to try and allocate the carbon budget at a company level, Carbon Tracker developed the carbon supply cost curve approach. First this requires splitting up the fossil fuels as each has its own regional markets, primary uses, and differing greenhouse gas intensities. Not to mention that the financial position of coal, oil and gas producers is clearly not the same. For each main market for each fuel, all the potential supply options are lined up in cost order and a demand intersect consistent with the scenario being analysed is applied. The economic logic applied is that the most competitive supply sources will be produced to meet demand, based on the relative costs of the projects. The full methodology is explained in an accompanying paper.

Oil is treated as a single global market as there is sufficient trading to justify that; gas is split up into global liquefied natural gas (LNG), Europe and North America, on top of other domestic markets. A single industry database (Rystad Energy UCube) is used to provide the relative costs of production. Any company may debate the precise levels of a specific project, but costs are not generally available otherwise and would not necessarily be on a consistent objective basis. Supply costs change over time and the analysis would have to be updated to understand how the positioning of a company’s portfolio of projects is changing going forward.

The costs of any particular project may change due to a range of factors, including efforts to reduce cost by the operator through improved design, or the level of activity in the sector inflating or deflating contractor and equipment costs. Particular regions or technologies may also progress relative to others. For example, the standardisation of drilling technology has contributed towards reduced costs, especially in US shale, largely in response to the lower oil price seen in recent years. For economies heavily reliant on hydrocarbon industries, (e.g. Venezuela, Russia), the change in oil price has also impacted currency valuations, which has affected the position on the cost curve when converted to US$. The exposure of companies to excess capex in a 2D scenario will also change as they sell and acquire interests in projects, undertake M&A activity at the corporate level, and explore for new discoveries.

Scenario analysis – degrees of warming

2D reference scenario

The International Energy Agency’s (IEA) 450 scenario has been used as the 2D demand scenario, as detailed in the World Energy Outlook 2016 (WEO). The 450 scenario is consistent with a 50% chance of delivering a 2°C global warming outcome, which is then worked back to estimate a demand scenario with this result. From a climate perspective, this is not great odds of achieving this outcome, therefore the scenario should be viewed at the generous end in terms of the levels of fossil fuel demand it accommodates. Demand is taken from the latest IEA scenarios on a fuel-by-fuel basis, and by region. The 450 scenario is then compared to a business as usual scenario, which reflects identified base case potential supply in the database used. At a macro level, this is slightly higher than the IEA New Policies Scenario (NPS).

As indicated by the TCFD, applying a consistent comparable 2D scenario enables investors to understand the relative exposure of companies within a portfolio. This does not prevent companies or other stakeholders from providing analysis of other scenarios they believe are more likely or more desirable.

Paris-related scenarios

The UNFCCC Conference of the Parties (COP) in Paris at the end of 2015 brought a focus on a range of outcomes either side of the 2D scenario, including the Nationally Determined Contributions (NDCs). These plans, which focus on commitments by individual countries for 2020-30, are currently not sufficient to achieve the 2D scenario, but could be ratcheted up in review phases.

The NPS is the IEA’s modelling outcome of where the world is currently headed, and takes into account the NDCs. The IEA NPS results in a carbon budget which is equivalent to a 50% likelihood of limiting anthropogenic warming to around 2.7°C. It is worth remembering that the IEA scenarios are updated each year and the latest NPS would not present much of a test compared to current industry plans where they already largely reflect the current policy environment. Trying to identify the gap between industry plans and NPS is of limited value.

Many investors are also aware of the wording from the UNFCCC Paris COP regarding limiting anthropogenic warming to “well below 2°C”, and pursuing efforts to “limit the temperature increase to 1.5°C”. These kinds of scenarios would present a very strict carbon budget requiring instant and drastic action to curtail emissions and keep fossil fuels in the ground. The IEA and IRENA highlighted some of the challenges to achieving an outcome below two degrees of warming in a recent analysis. There are limited details on the implications of a 1.5°C scenario for fossil fuel demand, therefore it is not currently possible to analyse in the same way as the IEA 450 scenario. The latest IEA Energy Technology Perspectives 2017 has produced a scenario which delivers a 50% probability of 1.75 degrees of warming which could be used as the basis for future analysis.

Scenarios are often misrepresented. Ultimately they are one version of the future, not a prediction or forecast. Use of a particular scenario does not mean that an organisation thinks it is the most likely or that it agrees with all of the underlying assumptions. Practically speaking, to conduct this analysis, there are very few publicly available scenarios that provide the detail on fossil fuel demand necessary to model the supply requirements. The IEA scenario provides a feasible reference point which is accepted by the industry. The most advanced companies already produce a range of scenarios to inform their thinking, and the reference scenario is not intended to limit or discourage companies going beyond it.

The carbon budget

In order to allocate the carbon budget from a given scenario to the company level, it is necessary to apply a timeframe. Oil and gas carbon budgets are derived from the 2016 IEA 450 scenario for the period 2017-2035. This is then correlated with the equivalent amount of oil and gas production over this period and the amount of capex that would be required through 2025 to deliver this supply. Considering production and it’s timing, rather than just reserves data, is essential to calculating the potential impact on revenues if investors wish to integrate this thinking into Net Present Value (NPV) sensitivity tests, as demonstrated later in this report.

The oil and gas carbon budget to 2035 for CO2 emissions based on the IEA 450 scenario is 320 GtCO2 split 59% for oil and 41% for gas. This amount of production is then compared to the business as usual scenario from the industry database to understand how much potential production and capital expenditure is excess to requirements in this scenario. It should be noted that not all of the surplus projects will have been granted a final investment decision or are certain to go ahead at this stage. In fact, this is the benefit of this scenario analysis – there is still time to review these decisions and for shareholders to engage on the capital expenditure plans of the company. For those companies that have already decided to align with a lower demand outlook, they can confirm that they have taken those options off the table. At present there is relatively little information about the status of different projects available for investors.

The overhang of potential emissions from business-as usual oil and gas use which exceeds the IEA 450 carbon budget to 2035 is as follows:

| Within budget (GtCO2) | Potencial outside budget (GtCO2) | Total (GtCO2) | |

| Oil | 188 | 32 | 220 |

| Gas | 132 | 29 | 160 |

| Total | 320 | 61 | 380 |

Note: totals may not add up due to rounding. Source: Rystad Energy, CTI analysis

This means that under the business as usual scenario the oil and gas industry would produce enough oil and gas to result in 380 GtCO2 by 2035.

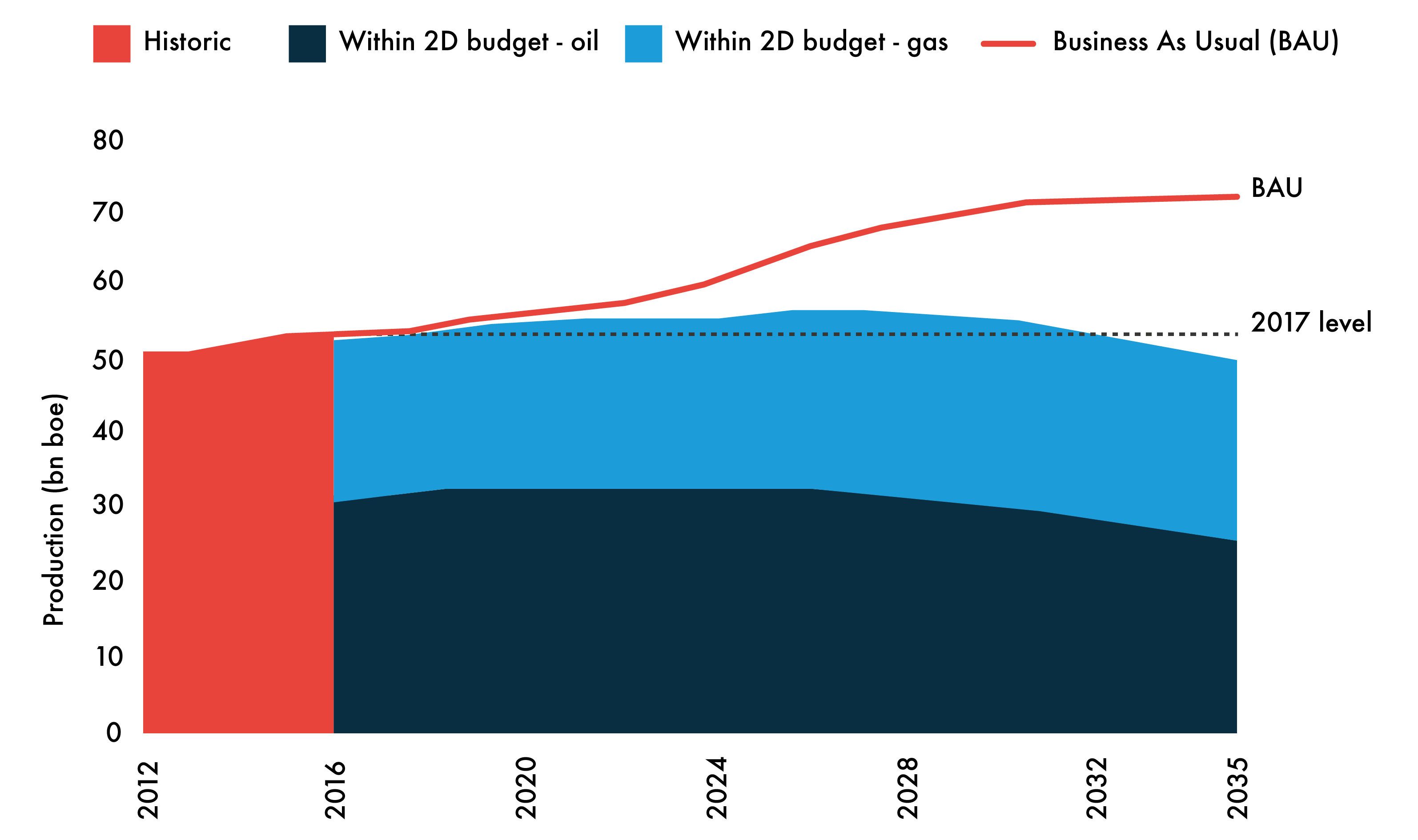

2D pathway for oil and gas production

The chart below gives an indication of how the total volumes of oil and gas consistent with the 2D scenario might be produced over the period to 2035 based on the base case timings of the projects within the 2D budget in our data. The annual production level of oil and gas combined is fairly consistent with today’s levels, but with an increasing share of gas over time. This is obviously a significant deviation from the continued growth expected in industry business-as-usual scenarios. However in the IEA 450 scenario oil and gas consumption does not disappear overnight as further supply is needed to meet demand. If a stricter budget were applied, then obviously less new production would be needed. The scenario sees a shift in the oil/gas mix from a 60:40 split to a more even distribution by the end of the period. This equates to a fall in oil production and growth in gas production.

Figure 1: Potential production pathway

Source: Rystad Energy, CTI analysis

This production profile is indicative, being based on the aggregate production required to meet demand in the IEA 450 Scenario over the period 2017-2035, rather than the actual pathways for oil & gas demand in the scenario. The base case timings of the projects within the 2D budget are used to calculate the chart, hence it will not match fossil fuel supply in the 450 Scenario on a year by year basis.

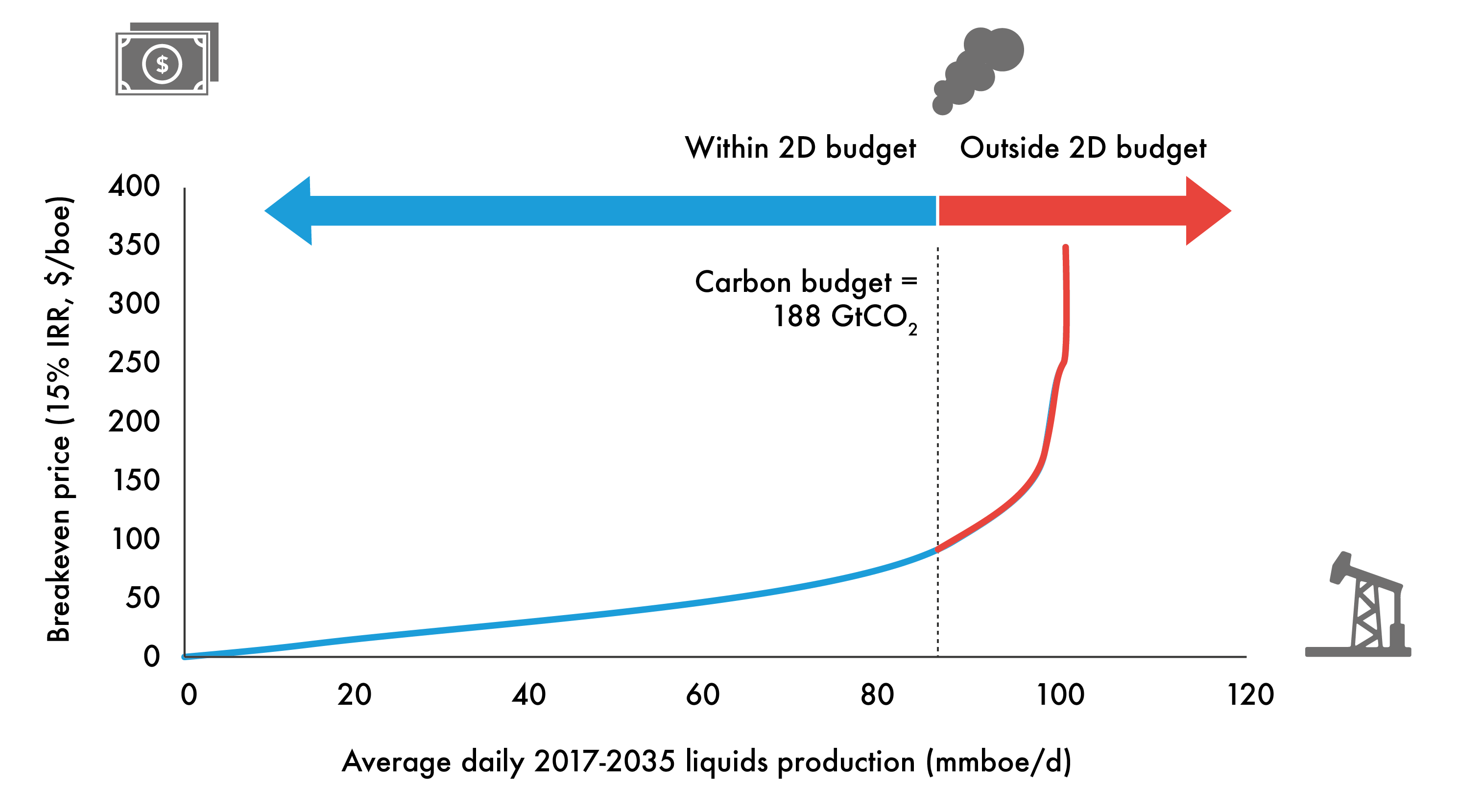

Carbon supply cost curves

To supply these levels of oil and gas, the most economic projects are selected – i.e. those on the left-hand side of the cost curve ordered by breakeven price. This leaves the highest cost options as those that would not need to proceed under a 2D scenario, assuming economic logic plays out. The breakeven price is the oil or gas price required to give a NPV of zero for each asset using a given discount rate or internal rate of return (IRR). In this case, we have used an IRR of 15%, illustrative of the minimum target return we see as being satisfactory for sanction given risks such as cost overruns, etc.

Global oil production is plotted on a single supply curve. Natural gas supply is split into regional markets – Europe, North America and global LNG. This means that the approach attempts to more closely replicate the regional allocation of the carbon budget, which will give a different result to combining all gas globally on the same cost curve. Domestic gas markets are assumed unchanged in a 2D scenario and account for 75 GtCO2.

Oil carbon supply cost curve

As a global market, the oil supply cost curve incorporates a wide range of different types of resource with different supply costs and different CO2 intensities. The high-cost projects are also typically the highest carbon, for example new oil sands or some deepwater projects.

Source: Rystad Energy, CTI analysis

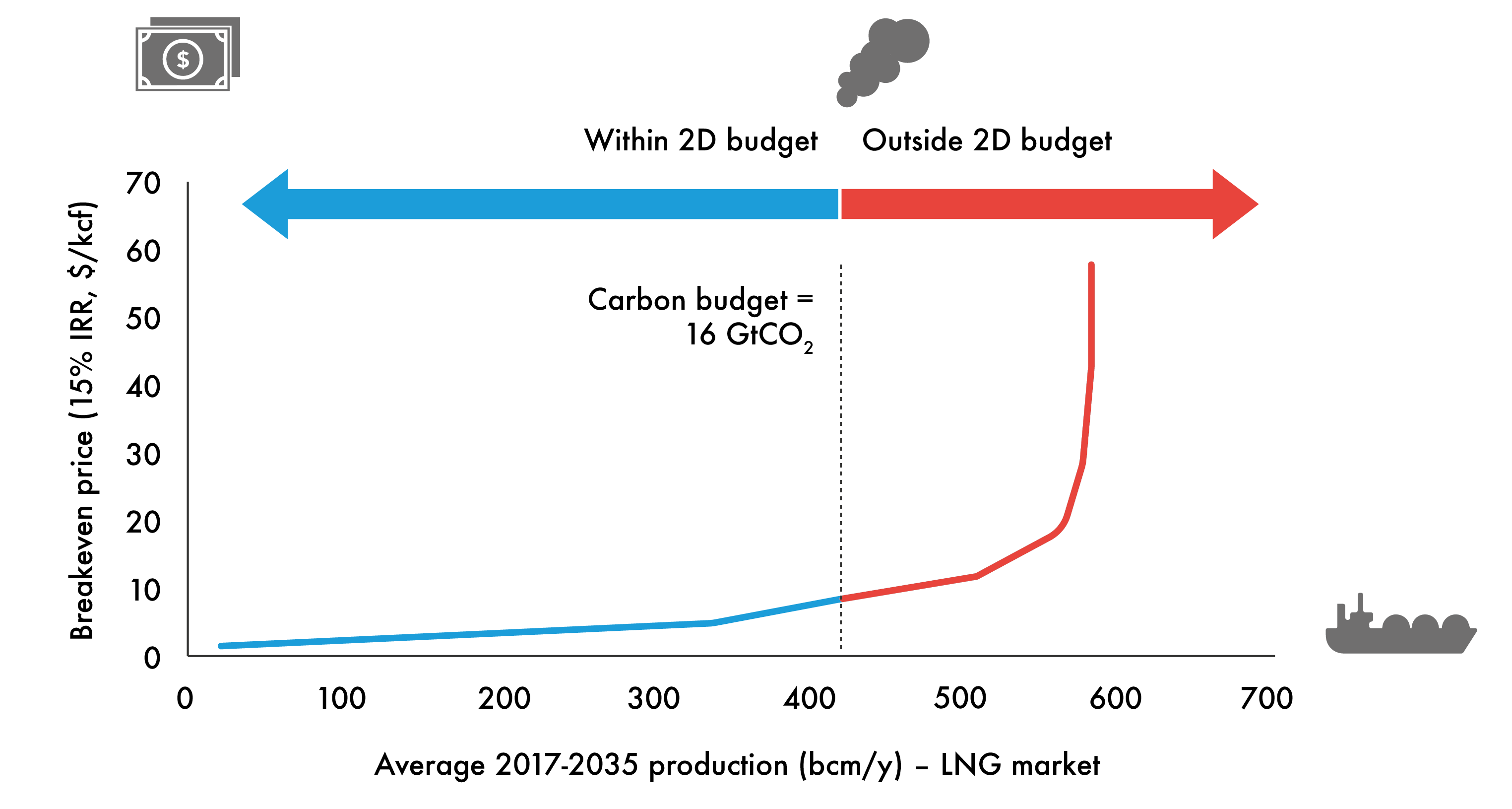

LNG carbon supply cost curve

Source: Rystad Energy, CTI analysis

Tight LNG markets and high pricing post-Fukushima encouraged over-investment in LNG liquefaction capacity, resulting in sharply lower prices for seaborne gas. Despite growth in demand, the market is generally expected to be oversupplied until the early to mid-2020s, and this overhang can be seen in the unneeded portion of supply. The weakness seen in gas prices has not incentivised further investment in new capacity, and has already resulted in some existing assets taking impairments. As well as typically being higher cost than other sources of gas, LNG is higher carbon due to the greater energy required to liquefy and transport it.

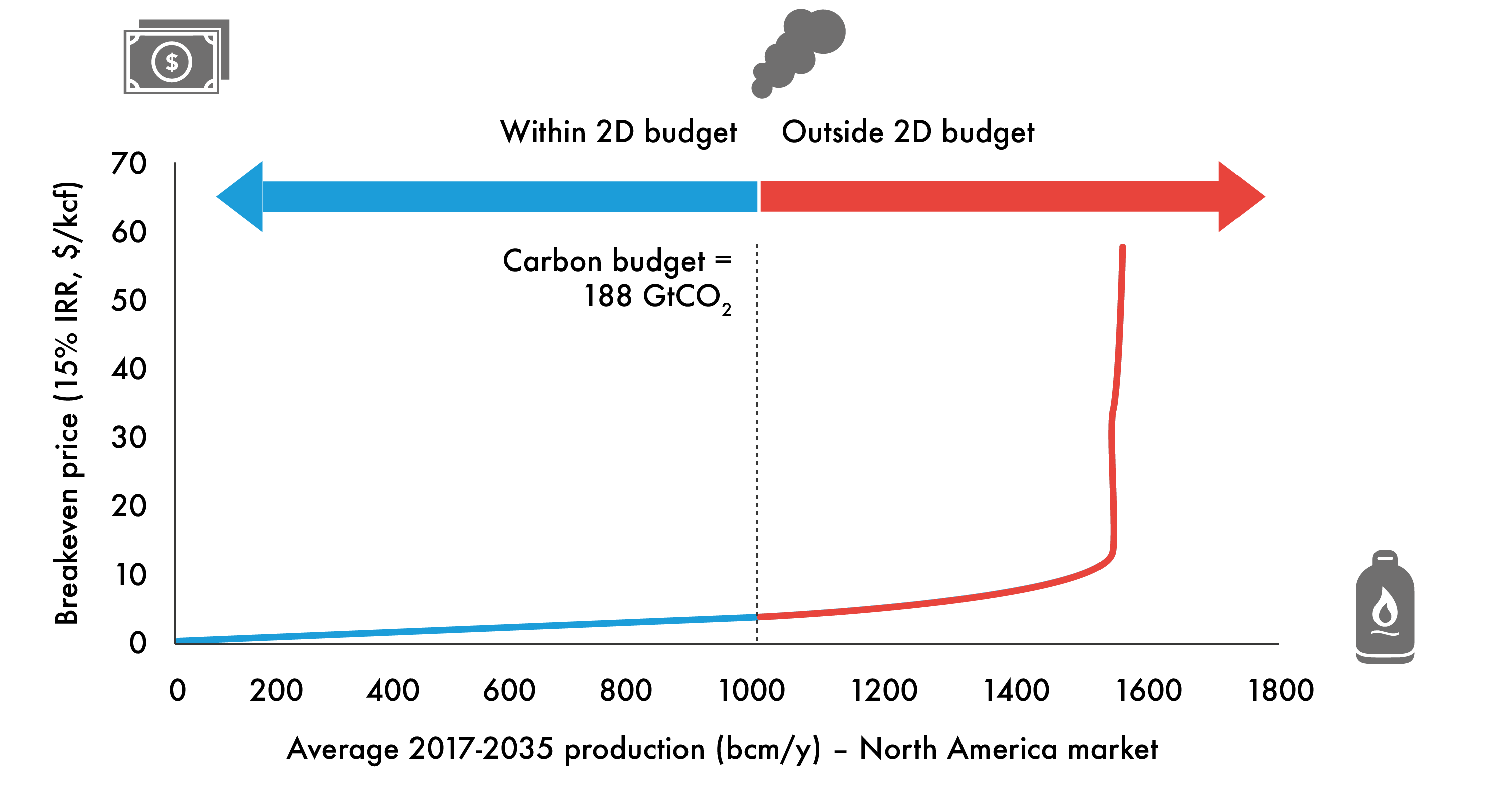

North American gas carbon supply cost curve

Source: Rystad Energy, CTI analysis

Increased production of North American gas has resulted in low prices and a favourable competitive position against coal, driving increased power sector use and lowering CO2 emissions. Lower levels of activity have reduced sub-contracting and supply chain costs, which will rise again if drilling ramps up materially strengthening the position of service providers. The efficiency gains and standardisation of drilling techniques provide a more permanent element to reduction in costs. These effects combine to move the whole cost curve down over the last couple of years. However, the resulting resource upgrades mean that there is also a significant proportion that is outside the 2D budget, even though supply costs are relatively low through much of the curve.

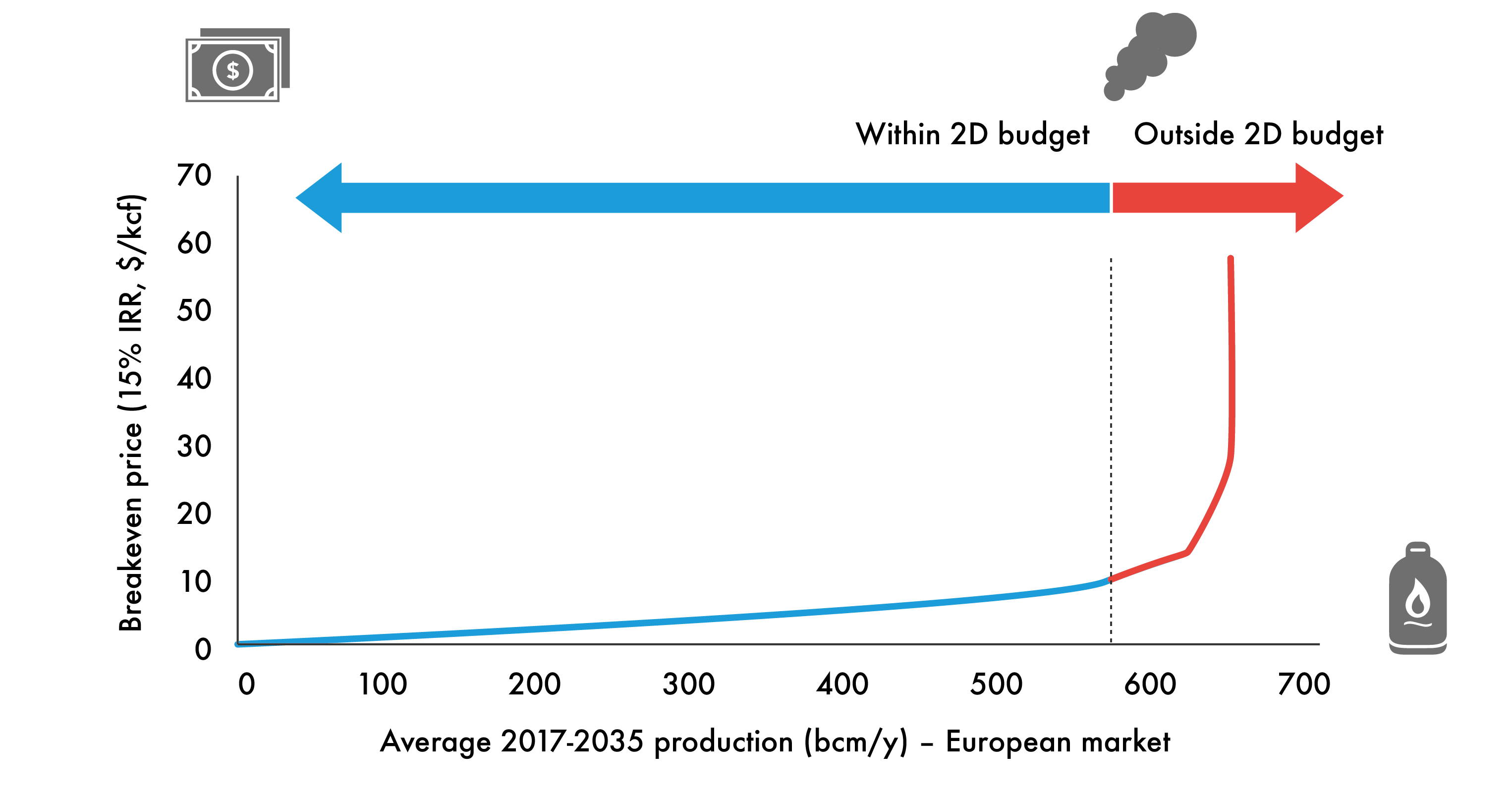

European gas supply cost curve

Source: Rystad Energy, CTI analysis

Gas for the European market is mostly needed despite weak energy demand – UK North Sea production has peaked, Norway is unlikely to have much scope to expand production significantly, and geological concerns have led to the imposition of increasingly strict quotas on production from the giant Groningen field in the Netherlands. Shale production remains something of an unknown, but the US’s success is unlikely to be repeated given more challenging sub-surface conditions and a range of social and environmental concerns, amongst other factors.

2D capex pathway

Having calculated the oil and gas production associated with a 2D scenario, we can then identify the level of capital expenditure required, and the delta to business-as-usual, (BAU). The drop in the oil price since 2014 has curtailed capex spending from the boom times when oil prices sat above US$100/bbl. The 2D pathway would see spending need to be kept down around the current level, rather than rebounding to previous levels.

It is worth noting that capex is always required just to maintain current levels of production due to the naturally declining production rates of oil and gas wells – the exception being some oil sands projects which have a more consistent production level due to the different production techniques used. As cheaper options are used up new projects being brought on will typically be higher cost, meaning that the investment per barrel of new production keeps increasing in the long term. Underneath, longer term trends are also the cyclical movements relating to cost deflation/inflation which are caused by the prevailing level of investment activity and degree of price pressure. The recent lower oil price levels have driven a round of cost-cutting and reduced demand and prices for oil and gas service industries.

Figure 2: Potential capex pathwayy

Source: Rystad Energy, CTI analysis

Capex

For capex, the analysis considers the related investment out to 2025 that corresponds with the level of production in the scenario.

Oil

Looking across the whole of the oil sector, including both listed and unlisted companies, 33% of business-as-usual oil capex does not need to be spent in the 2D scenario. There is obviously a range of percentages in terms of company level exposure – with some companies having capex plans entirely within the 2D budget and others being largely not needed in a 2D scenario.

| Capex ($tr) | Oil |

| Within 2D budget | $ 3.2 |

| Not needed | $ 1.6 |

| Total | $ 4.8 |

Source: Rystad Energy, CTI analysis

Gas

In total, 31% of business-as-usual gas capex is not needed in the 2D scenario – similar to the overall oil level. Domestic gas markets are assumed to continue to supply to meet demand. For the regional markets, 60% LNG, 60% North America, and 37% European capex is surplus to requirements to 2025 in a 2D scenario. This challenges the growth plans of operators in these markets.

| Capex ($tr) | LNG | North America | Europe | Other | Total |

| Within 2D budget | $ 0.2 | $ 0.2 | $ 0.2 | $ 1.0 | $ 1.6 |

| Not needed | $ 0.2 | $ 0.4 | $ 0.1 | $ 0.0 | $ 0.7 |

| Total | $ 0.4 | $ 0.6 | $ 0.3 | $ 1.0 | $ 2.4 |

Note: totals may not add up due to rounding. Source: Rystad Energy, CTI analysis

Exposure across different types of company

The table below indicates that around 60% of the potential capex and production that is not consistent with a 2D scenario is associated with companies in the private sector. The quarter of production that has state ownership also includes INOCs (International National Oil Companies – NOCs that have greater geographic reach) – many of which have partial listings, eg Statoil, Petrobras. Therefore there is still some capital markets exposure to these projects, even if the potential for influence is diminished. This shows that whilst NOCs have a big role in oil and gas production, they are less at risk under a lower demand scenario.

| 2017-2035 production (mmboe/d) | 2017-2025 production (mmboe/d) | ||||

| Needed | Not Needed | Needed | Not Needed | ||

| NOC | 55 | 4 | 1.2 | 0.3 | |

| INOC | 25 | 3 | 0.9 | 0.3 | |

| Major | 21 | 6 | 0.7 | 0.4 | |

| Integrated | 11 | 2 | 0.4 | 0.1 | |

| E&P Company | 8 | 4 | 0.4 | 0.3 | |

| Independent | 18 | 5 | 0.7 | 0.3 | |

| Exploration Company | 1 | 1 | 0.1 | 0.1 | |

| Industrial | 3 | 1 | 0.1 | 0.1 | |

| Investor | 12 | 0 | 0.0 | 0.0 | |

| Operating Company | 0 | 0 | 0.0 | 0.0 | |

| Unknown | 0 | 0 | 0.0 | 0.0 | |

| Unspecific (Other/Open/ Relinquished) | 5 | 3 | 0.3 | 0.4 | |

| Total | 147 | 28 | 4.9 | 2.3 | |

| NOC+INOC | 79 | 6 | 2.1 | 0.6 | |

| Private sector | 64 | 19 | 2.4 | 1.4 | |

| NOC+INOC % of total | 54% | 23% | 44% | 24% | |

| Private sector % of total | 43% | 68% | 50% | 59% | |

Note – unknown and unspecific not allocated to either NOC+INOCs or private sector. Source: Rystad Energy, CTI analysis

Company and project exposure

Exposure to capex outside the 2D budget varies widely throughout the curve. Companies that have a lower percentage of unneeded capex can be seen as more aligned with a 2D budget; companies with a greater percentage of unneeded capex warrant further attention from investors. Further disclosure could be requested to explain how the company is attempting to be more “future proof” by expressly cancelling or selling high-cost projects, or reconsidering its business model entirely.

For a sample universe of companies, the percentage of total potential capex that is outside the 2D budget is shown below. Percentage of upstream capex has been arranged into bands, with companies with more than a third of capex outside of 2D having higher than average exposure.

| Company | Country of headquarters | % of upstream capex outside 2D budget (% band) | 2017-2035 carbon budget (GtCO2) | Potential CO2 outside 2D carbon budget (GtCO2) |

| Southwestern Energy | United States | 60% - 70% | 1.0 | 0.6 |

| Apache | United States | 60% - 70% | 1.1 | 1.0 |

| Cabot Oil and Gas | United States | 50% - 60% | 0.6 | 0.4 |

| Energen | United States | 50% - 60% | 0.2 | 0.1 |

| Murphy Oil | United States | 50% - 60% | 0.4 | 0.3 |

| Concho Resources | United States | 50% - 60% | 0.4 | 0.3 |

| Imperial Oil (Public traded part) | Canada | 50% - 60% | 0.4 | 0.2 |

| Vermilion Energy | Canada | 50% - 60% | 0.1 | 0.1 |

| Oil Search | Papua New Guinea | 50% - 60% | 0.2 | 0.1 |

| Encana | Canada | 50% - 60% | 1.0 | 0.6 |

| Chesapeake | United States | 40% - 50% | 1.8 | 1.2 |

| Inpex | Japan | 40% - 50% | 1.4 | 0.3 |

| ExxonMobil | United States | 40% - 50% | 8.6 | 3.1 |

| Husky Energy | Canada | 40% - 50% | 0.9 | 0.3 |

| Woodside | Australia | 40% - 50% | 0.7 | 0.3 |

| Suncor Energy | Canada | 40% - 50% | 2.3 | 0.4 |

| EQT Corporation | United States | 30% - 40% | 1.2 | 0.4 |

| Devon Energy | United States | 30% - 40% | 1.6 | 0.5 |

| Chevron | United States | 30% - 40% | 6.4 | 2.0 |

| Eni | Italy | 30% - 40% | 4.6 | 1.1 |

| Shell | Netherlands | 30% - 40% | 9.9 | 2.7 |

| Galp Energia SA | Portugal | 30% - 40% | 0.3 | 0.1 |

| Canadian Natural Resources (CNRL) | Canada | 30% - 40% | 2.0 | 0.5 |

| Noble Energy | United States | 30% - 40% | 1.3 | 0.6 |

| Repsol | Spain | 30% - 40% | 1.8 | 0.3 |

| Newfield Exploration | United States | 30% - 40% | 0.4 | 0.2 |

| Total | France | 30% - 40% | 6.3 | 1.2 |

| Crescent Point Energy | Canada | 30% - 40% | 0.2 | 0.1 |

| Hess | United States | 30% - 40% | 0.8 | 0.2 |

| Origin Energy | Australia | 30% - 40% | 0.3 | 0.1 |

| Rosneft | Russia | 30% - 40% | 9.5 | 1.3 |

| Continental Resources | United States | 20% - 30% | 0.7 | 0.3 |

| Anadarko | United States | 20% - 30% | 2.5 | 0.6 |

| Cimarex Energy | United States | 20% - 30% | 0.7 | 0.1 |

| Occidental Petroleum | United States | 20% - 30% | 1.6 | 0.5 |

| BP | United Kingdom | 20% - 30% | 6.5 | 1.5 |

| Lukoil | Russia | 20% - 30% | 5.0 | 0.5 |

| PetroChina | China | 20% - 30% | 9.6 | 0.7 |

| ConocoPhillips | United States | 20% - 30% | 3.8 | 0.8 |

| EOG Resources | United States | 20% - 30% | 2.3 | 0.6 |

| CNOOC | China | 20% - 30% | 2.9 | 0.5 |

| Gazprom | Russia | 20% - 30% | 17.8 | 2.0 |

| Santos | Australia | 20% - 30% | 0.4 | 0.1 |

| Statoil | Norway | 20% - 30% | 4.3 | 0.6 |

| Rice Energy | United States | 20% - 30% | 0.7 | 0.1 |

| RSP Permian | United States | 10% - 20% | 0.4 | 0.1 |

| Marathon Oil | United States | 10% - 20% | 1.1 | 0.2 |

| OMV | Austria | 10% - 20% | 0.5 | 0.1 |

| QEP Resources | United States | 10% - 20% | 0.4 | 0.1 |

| Cenovus Energy | Canada | 10% - 20% | 0.9 | 0.1 |

| Tullow Oil | United Kingdom | 10% - 20% | 0.3 | 0.0 |

| Parsley Energy | United States | 10% - 20% | 0.2 | 0.0 |

| Ecopetrol | Colombia | 10% - 20% | 0.8 | 0.1 |

| Lundin Petroleum | Sweden | 10% - 20% | 0.3 | 0.0 |

| Sinopec | China | 10% - 20% | 2.3 | 0.2 |

| Pioneer Natural Resources | United States | 0% - 10% | 1.8 | 0.2 |

| Peyto | Canada | 0% - 10% | 0.3 | 0.1 |

| Petrobras | Brazil | 0% - 10% | 5.9 | 0.4 |

| Surgutneftegas | Russia | 0% - 10% | 2.0 | 0.0 |

| Tatneft | Russia | 0% - 10% | 1.1 | 0.0 |

| Range Resources | United States | 0% - 10% | 2.0 | 0.0 |

| Saudi Aramco | Saudi Arabia | 0% - 10% | 30.2 | 0.4 |

| Novatek | Russia | 0% - 10% | 2.8 | 0.1 |

| Arc Resources | Canada | 0% - 10% | 0.5 | 0.0 |

| Gulfport Energy | United States | 0% - 10% | 0.8 | 0.0 |

| Tourmaline Oil | Canada | 0% - 10% | 1.0 | 0.0 |

| Diamondback Energy | United States | 0% - 10% | 0.4 | 0.0 |

| Antero Resources | United States | 0% - 10% | 1.3 | 0.0 |

| Seven Generations Energy | Canada | 0% - 10% | 0.7 | 0.0 |

Source: Rystad Energy, CTI analysis

It is clear that some companies would have to forego the majority of their options in a 2D future, significantly impacting growth plans. Other companies are already highly resilient to this scenario, including Saudi Aramco for example. Oil sands operators generally do not perform well, which reflects the ongoing challenges to expanding production with both carbon limits and export infrastructure constraints. Shale operators are spread along the cost curve, with some positions performing better than others.

Optionality & flexibility

Discussions with oil companies indicate that there is a desire to retain a certain amount of optionality to allow flexibility depending on which future emerges, responding to possible changes in oil price. In other words, to retain some higher-cost projects as future development possibilities without committing if not warranted in the price environment at the time. This is understandable, but will only deliver a 2D aligned scenario if all companies choose not to exercise this optionality. Different types of project also offer greater flexibility. For example, US shale producers have relatively short cycle options which offer greater ability to reduce investment and lower production quickly. Conversely, major projects with high initial capital investment and long payback periods such as greenfield oil sands projects or LNG plants are more difficult to wind down and expose developers to longer periods of risk.

However, such optionality is not entirely cost free – for example, companies may have to pay fees to acquire acreage even if it is not developed, or licence terms may commit them to an exploration programme. Furthermore, companies that are encouraged by higher oil prices to press ahead with such projects run the risk of being caught out by prices deteriorating after they have committed material capital, like some of those sanctioned prior to 2014’s downturn.

Company carbon budgets equivalent to the UK

It is also worth noting how significant the production of the oil majors and NOCs are in terms of the remaining carbon budget. As context, the UK-estimated carbon budget for the period 2018-32 is 6.26 GtCO2 according to the UK Climate Change Committee. This means that a single major company is producing enough oil and gas to use up the UK’s entire carbon budget for the period. This demonstrates the importance of investors tackling climate change by ensuring major oil companies are aligning with climate objectives.

High cost projects – examples of projects outside the 2D budget

The largest projects that are outside the 2D budget can be put forward as examples of high cost options that should not be pursued in a demand-constrained world. In this exercise, high risk projects are listed in order of capex, giving an indication of the possible financial risk of developing them. The list is limited to projects which are “new”, meaning either at the discovery stage or not yet discovered (i.e. excluding projects which are already in production or under development). Undeveloped projects have lower sunk costs, and are thus easier to cancel than projects which have already received significant capital, and would therefore require the company to write that expenditure off.

Companies may have already decided to defer or cancel some of these projects, and revisit a final investment decision in the future. This is where companies can provide transparency about which projects they see are part of their future strategy, or how they think they are aligned or not with a 2D scenario. This list highlights projects that the cost curve data indicates are not consistent with a 2D scenario – the companies are best placed to indicate where in their project pipeline a project sits. Whilst a certain degree of optionality around the marginal production point is sensible, the highest cost projects are clearly those that are most at risk in a 2D world (and indeed are highest risk and lowest return in any demand scenario).

For example, the five oil projects with the highest capex not needed outside the 2D budget are shown in the table below.

| Project | Kashagan, KZ | Lulu, NS | Junin-6, VE | Bonga Southwest- Aparo, NG | Bonga, NG |

| Asset | Kashagan (Phase 2), KZ | Lulu, NS | Junin-6 (Phase 2), VE | Bonga Southwest, NG | Bonga North, NG |

| Companies | Total, Eni, KazMunaiGaz (parent), Shell, CNPC (parent), Samruk Kazyna, ExxonMobil, Inpex | PDVSA, Rosneft, Gazprom, Gazprom Neft (Public traded part) | Saudi Aramco, Kuwait Petroleum Corp (KPC) | Eni, Chevron, Total, Shell, Lukoil, ExxonMobil | Eni, Shell, ExxonMobil, total |

| Life cycle stage | Discovery | Discovery | Discovery | Discovery | Discovery |

| Category | Conventional (land/shelf) |

Deep water | Conventional (land/shelf) | Deep water | Deep water |

| 2017-2025 potential capex | 33.5 | 17.9 | 10.2 | 9.6 | 9.2 |

| Breakeven band (15% IRR) | 110-120 | 90-100 | 150+ | 100-110 | 90-100 |

| 2017-2035 carbon emissions | 0.5 | 0.2 | 0.1 | 0.1 | 0.1 |

Source: Rystad Energy, CTI analysis

At the global level, some of the largest projects outside the 2D budget will be in the hands of state-owned companies, making them less transparent and moving the risks to taxpayers rather than private investors.

NPV sensitivity

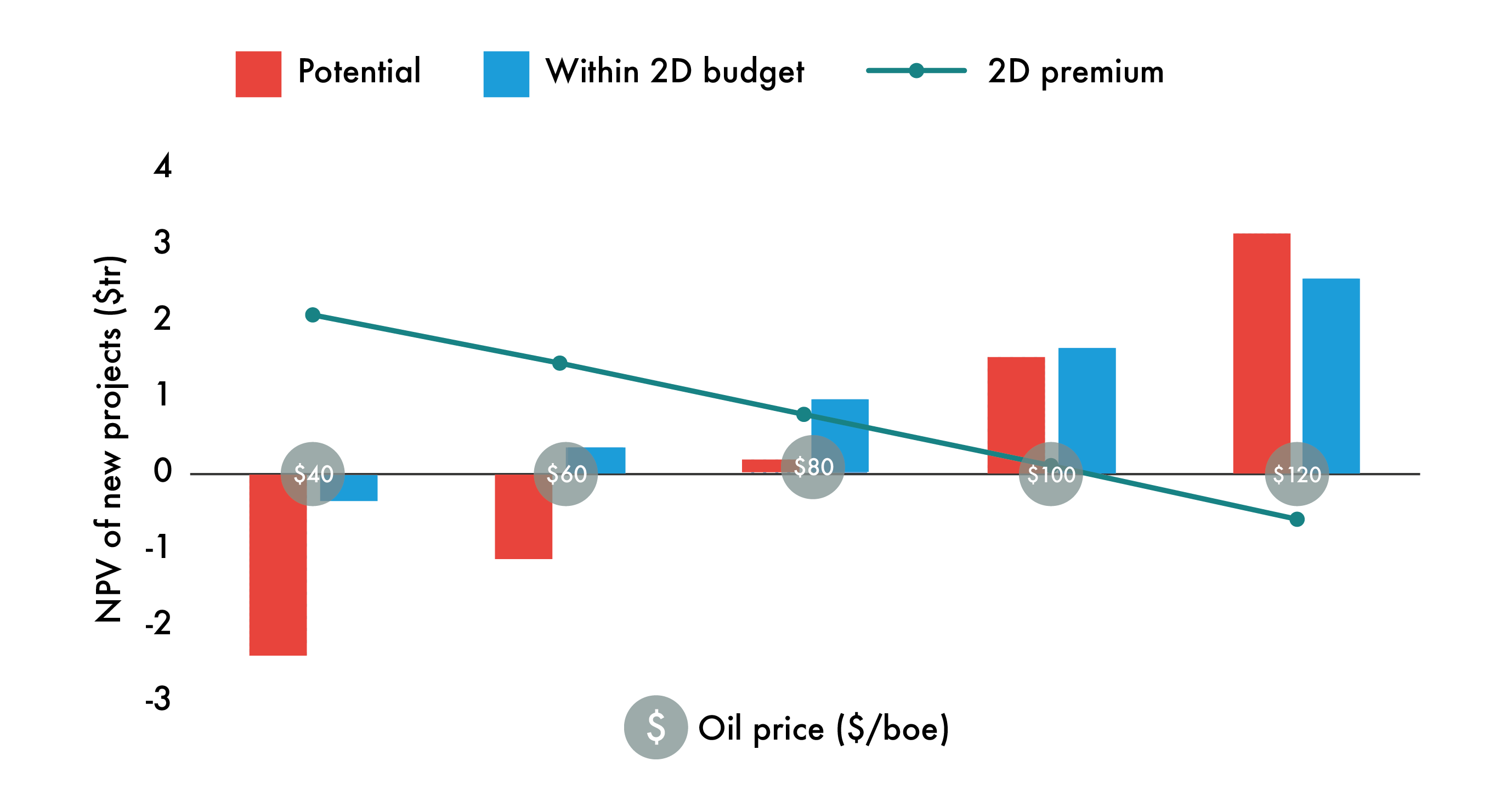

A common method of valuing oil and gas projects is net present value (NPV), the sum of future free cash flows using a given discount rate (here 10%). The NPVs of a company’s 2D-compliant portfolio and its BAU portfolio can be compared to give an insight into the cost structures of the two and their relative values. As the key driver of NPV is the oil price, the values of the two portfolios can be sensitised to different oil prices, and hence relative leverage to the oil price (and hence relative volatility) can be determined. This concept was explored in Carbon Tracker’s Sense & Sensitivity report.

As most producing projects are within the 2D budget, the 2D premium (the greater value of the 2D portfolio than the BAU portfolio) particularly comes out in relation to new projects, which are the focus on this indicator. The chart shows how the 2D premium across the global oil and gas industry would be around US$1.4trn if prices average around US$60/bbl going forward at a 10% discount rate. The 2D future can therefore be positive in value terms for the oil and gas industry overall as long as it aligns with it and does not bet on high demand and prices.

Figure 3: NPV sensitivity to oil price

Source: Rystad Energy, CTI analysis

As the 2D portfolio constitutes the lower-cost portion of the BAU portfolio that fits within the 2D budget, it is lower cost on average. Accordingly, it has higher margins, and outperforms the BAU portfolio at lower oil prices.

Oil prices need to not only rise, but also be sustained at higher levels. For example high cost projects that were sanctioned based on the 3 years or so of US$100+/bbl prices pre-mid 2014 will have lost value for shareholders since. Some impairments have already been taken as a result of price cuts. In order for the high cost non-2D compliant oil projects to be worth developing (in aggregate), oil prices will need to average above US$100/bbl. Above this point, the oil price becomes so high that it is worth doing the additional high-cost projects – although this implies that global climate targets will be missed, assuming all else remains the same. (Other factors such as political risk will impact the actual oil price, but this is designed as a simple exercise to indicate relative price sensitivity of two production scenarios.) At lower oil prices, sticking to the smaller 2D compliant subset delivers significantly more value (or loses less) than going ahead with more expensive options.

It can also be noted that, due to the higher cost structure of the BAU portfolio, it is more geared to the oil price – that is, its value changes more for a given change in the oil price than the 2D portfolio. This implies higher volatility and higher risk, and accordingly investors calculating the NPV of the BAU portfolio should use a higher discount rate, which would reduce its value further compared to the 2D portfolio. This is outside of the scope of this exercise, but is noted for interest.

A further point that is worth considering on the topic of NPV is the concept of reinvestment risk. As noted, the NPV of a project is the sum of future discounted cash flows. However, in order for that value to be realised as a shareholder, the free cash flows must be distributed to investors via dividends. To the extent that any of these cash flows are not distributed, but are subsequently invested in future projects, this value is then transferred into the future (assuming that the company invests at its cost of capital) when that new project starts producing. In the case of conventional projects, this may be another ten years or more, when there will be even greater uncertainties relating to competing technologies and environmental regulations, and a greater difference between the 2D and BAU demand pathways. Therefore, even the value realised from the 2D portfolio is reliant on the company’s subsequent capital allocation decisions.

This is an example of how analysts could test the financial implications of a 2D scenario aligned strategy and integrate this kind of scenario analysis into their thinking.