THE TOP 100 EXTERNALITIES OF BUSINESS

APRIL 2013

Trucost has undertaken this study on behalf of the TEEB for Business Coalition.1 Findings of this report build on TEEB’s The Economics of Ecosystems and Biodiversity in Business and Enterprise2 and the World Business Council for Sustainable Development’s Guide to Corporate Ecosystem Valuation.3

RESEARCH AND ANALYSIS: TRUCOST PLC

ACKNOWLEDGEMENTS

Thank you to the project steering group (Pavan Sukhdev GIST Advisory, Dr. Dorothy Maxwell TEEB for

Business Coalition, Richard Spencer ICAEW, Claire Jones ICAEW, Ilana Taub ICAEW, James Vause UK Department for Environment Food and Rural Affairs, Emily McKenzie Natural Capital Project WWF, Jeremy Osborn Ernst & Young), peer reviewers (Professor John Barrett School of Earth and Environment University of Leeds and Dr. Sangwon Su Bren School of Environmental Science and Management University of California Santa Barbara) and Nicolas Bertrand UNEP TEEB, Tobias Hartmann Global Nature Fund, Eva Zabey WBCSD, Suzanne Osment WRI.

Trucost Plc

Trucost has been helping companies, investors, governments, academics and thought leaders to understand the economic consequences of natural capital dependency for over 12 years. Our world leading data and insight enables our clients to identify natural capital dependency across companies, products, supply chains and investments; manage risk from volatile commodity prices and increasing environmental costs; and ultimately build more sustainable business models and brands. Key to our approach is that we not only quantify natural capital dependency, we also put a price on it, helping our clients understand environmental risk in business terms. It isn’t “all about carbon”; it’s about water; land use; waste and pollutants. It’s about which raw materials are used and where they are sourced, from energy and water to metals, minerals and agricultural products. And it’s about how those materials are extracted, processed and distributed. www.trucost.com

TEEB for Business Coalition

The TEEB for Business Coalition is a global, multi stakeholder platform for supporting the uptake of natural capital accounting in business decision-making. The Coalition is the business application of G8 and United Nations Environment Programme supported TEEB (The Economics of Ecosystems and Biodiversity) programme. The Coalition activities focus on raising awareness of the business case for natural capital accounting, research and

supporting development of harmonised methods for measuring, managing and reporting environmental externalities in business. www.teebforbusiness.org

Design by Rebecca Edwards, Trucost Plc

ACKNOWLEDGEMENTS

ACKNOWLEDGEMENTS

The information used to compile this report has been collected from a number of sources in the public domain and from Trucost’s licensors. Some of its content may be proprietary and belong to Trucost or its licensors. The report may not be used for purposes other than those for which it has

been compiled and made available to you by Trucost. Whilst every care has been taken by Trucost in compiling this report, Trucost accepts no liability whatsoever for any loss (including without limitation direct or indirect loss and any loss of profit, data, or economic loss) occasioned to any person nor for any damage, cost, claim or expense arising from any reliance on this report or any of its content (save only to the extent that the same may not be in law excluded). The information in this report does not constitute or form part of any offer, invitation to sell, offer to subscribe for or to purchase any shares or other securities and must not be relied upon in connection with any contract relating to any such matter. ‘Trucost’ is the trading name of Trucost plc a public limited company registered in England company number 3929223 whose registered office is at One London Wall, London EC2Y 5AB, UK.

© Trucost 2013

2

TERM, ACRONYM OR ABBREVIATION | MEANING |

Abatement cost | Cost of reducing an environmental impact. |

Benefits transfer | Technique by which an environmental value is transferred from one location to another. |

Cost of capital | The cost of equity, and long and short-term debt. |

Direct environmental impacts | Impacts from a company's own operations. |

Ecosystem | Dynamic complex of plant, animal and micro-organism communities and their non-living environment interacting as a functional unit. Together with deposits of non-renewable resources they constitute 'natural capital'. |

Ecosystem services | Goods (renewable resources such as water and food) and services (such as pollination and purification of water) provided by specific ecosystems to humans. An overview is available at URL: http://www.teebweb.org/resources/ecosystem-services. |

EEIO | Environmentally extended input-output model; a model that maps the flow of inputs and environmental impacts through an economy. |

EKPI | Environmental Key Performance indicator; environmental impact categories developed by Trucost for appraisal of businesses, sectors and regions. |

Emissions factor | Unit of an environmental impact per unit of physical production. |

Environmental value | The value to people from environmental goods and services. Where no market price exists, it can be estimated in monetary terms by using environmental valuation methods. |

External cost | Cost borne by third parties not taking part in an economic activity. |

FAO | Food and Agriculture Organization of the United Nations. |

GHG | Greenhouse gas. |

Gross value-added | The difference between the output value and raw material input costs for a sector or product. |

IEA | International Energy Agency. |

Impact | Environmental impact either in physical units or as a monetary value (cost). |

Impact ratio | Natural capital cost as a percentage of monetary output (revenue). |

Indirect environmental impacts | Impacts from a company’s supply chain (this study has focused on upstream as opposed to product-use or downstream impacts). |

Internal cost | Cost borne by parties taking part in an economic activity. |

Internalize | When external costs are privatized to the creator of those costs e.g. a polluter |

IRWR | Internal Renewable Water Resource; long-term average annual flow of rivers and recharge of aquifers generated from endogenous precipitation. |

KWh | A unit of energy equivalent to one kilowatt (1 kW) of power expended for one hour (1 h) of time. |

MWh | A unit of energy equivalent to one megawatt (1 MW) of power expended for one hour (1 h) of time. |

Natural capital | The finite stock of natural assets (air, water and land) from which goods and services flow to benefit society and the economy. It is made up of ecosystems (providing renewable resources and services), and non-renewable deposits of fossil fuels and minerals. |

PM | Particulate matter. |

Region-sector | An industry sector broken down by region. Regions have been defined according to the United Nations continental sub-regional definitions (Available at URL: http://unstats.un.org/unsd/methods/m49/m49regin.htm) (See Appendix 5). |

Renewable water resource | Surface flow and recharged groundwater available to an area. |

Social cost | Cost to society as a whole of an action, such as an economic activity, equal to the sum of internal costs plus external costs. |

TEEB | The Economics of Ecosystems and Biodiversity. |

U.S. EPA | United States Environmental Protection Agency. |

Water scarcity | Percentage of the annually renewable water resource used in a particular area. |

![]()

GLOSSARY

GLOSSARY

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 3

1. FOREWORD | 6 |

2. EXECUTIVE SUMMARY | 7 |

3. BACKGROUND | 14 |

3. 1 WHY NOW? | 14 |

3.2 OUTPUTS AND APPLICATION | 15 |

3.3 MEASURING IMPACTS | 15 |

3.3.1 Direct environmental impacts | 15 |

3.3.2 Valuation | 18 |

4. PROJECT METHODOLOGY | 19 |

4.1 LIMITATIONS OF THE APPROACH | 20 |

4.2 EKPIs | 20 |

4.2.1 Land use | 20 |

4.2.2 Water consumption | 22 |

4.2.3 Greenhouse gases | 24 |

4.2.4 Air pollution | 24 |

4.2.5 Land and water pollution | 26 |

4.2.6 Waste | 27 |

5. THE RANKINGS | 28 |

5.1 THE GLOBAL 100 EXTERNALITIES | 30 |

5.2 THE GLOBAL 20 REGION SECTORS | 31 |

5.3 RANKING BY IMPACT, SECTOR AND REGION | 32 |

5.3.1 Land use | 33 |

5.3.2 Water consumption | 36 |

5.3.3 Greenhouse gases | 38 |

5.3.4 Air pollution | 40 |

5.3.5 Land and water pollution | 43 |

5.3.6 Waste | 45 |

5.3.7 Consumer sectors drive natural capital costs | 47 |

CONTENTS

CONTENTS

4

6. SO WHAT DOES THIS MEAN? | 52 |

6.1 RECOMMENDATIONS | 53 |

7. APPENDICES | 54 |

7. 1 APPENDIX 1: THE RANKINGS | 54 |

7.1.1 The Global 100 Externalities | 54 |

7.1.2 The Global 20 Region-Sectors | 56 |

7.1.3 The Global 20 Region-Sectors: Land use | 57 |

7.1.4 The Global 20 Region-Sectors: Water consumption | 57 |

7.1.5 The Global 20 Region-Sectors: GHG emissions | 58 |

7.1.6 The Global 20 Region-Sectors: Air pollution | 58 |

7.1.7 The Global 20 Region-Sectors: Land and water pollution | 59 |

7.1.8 The Global 20 Region-Sectors: Waste | 59 |

7.1.9 Sectors with the greatest overall impacts and at least 50% of impacts in the supply chain | 60 |

7.2 APPENDIX 2: TRUCOST’S EEIO MODEL AND DATA | 61 |

7.2.1 Indirect model | 61 |

7.2.2 Direct model | 61 |

7.2.3 Multi-regional models versus bottom-up impact factor adjustments | 62 |

7.3 APPENDIX 3: TRUCOST SECTOR LIST | 63 |

7.4 APPENDIX 4: LIST OF ENVIRONMENTAL IMPACTS MEASURED AND VALUED IN THIS STUDY | 74 |

7.5 APPENDIX 5: COMPOSITION OF MACRO GEOGRAPHICAL (CONTINENTAL) REGIONS, GEOGRAPHICAL SUB-REGIONS, AND SELECTED ECONOMIC AND OTHER GROUPINGS | 77 |

8. REFERENCES | 78 |

![]()

CONTENTS

CONTENTS

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 5

This report offers a high level perspective on the world’s biggest natural capital risks for business, investors and governments.

To provide a business perspective, it presents natural capital risk in financial terms. In doing so, it finds that the world’s 100 biggest risks are costing the economy around $4.7 trillion per year in terms of the environmental and social costs of lost ecosystem services and pollution.

Many of these natural capital costs are found in the developing world, but the resulting goods and services are being consumed by resource intensive supply chains around the planet – thus it is a global challenge for a globalized world.

Although internalization of natural capital costs has only occurred at the margin, 3 billion new middle class consumers by 2030 will cause demand to continue to grow rapidly, while supply will continue to shrink. The consequences in the form of health impacts and water scarcity will create tipping points for action by governments and societies. The cost to companies and investors will be significant.

This research provides a high-level insight into how companies and their investors can measure and manage natural capital impacts. While it has limitations, it should act as a catalyst for further research into high risk areas, and mitigation action. For governments it should spark further debate around the risks their countries face, and whether natural capital is being consumed in an economically efficient manner. The scale of the risks identified suggests that all actors have the opportunity to benefit.

FOREWARD

FOREWARD

6

HIGHLIGHTS

THE PRIMARY PRODUCTION AND PRIMARY PROCESSING SECTORS ANALYZED IN THIS STUDY ARE ESTIMATED TO HAVE UNPRICED NATURAL CAPITAL COSTS

TOTALLING US$7.3 TRILLION, WHICH EQUATES TO 13% OF GLOBAL ECONOMIC OUTPUT

IN 2009.

THE MAJORITY OF UNPRICED NATURAL CAPITAL COSTS ARE FROM GREENHOUSE GAS EMISSIONS (38%) FOLLOWED

BY WATER USE (25%); LAND USE (24%); AIR POLLUTION (7%), LAND

AND WATER POLLUTION (5%) AND

HIGHLIGHTS

THE PRIMARY PRODUCTION AND PRIMARY PROCESSING SECTORS ANALYZED IN THIS STUDY ARE ESTIMATED TO HAVE UNPRICED NATURAL CAPITAL COSTS

TOTALLING US$7.3 TRILLION, WHICH EQUATES TO 13% OF GLOBAL ECONOMIC OUTPUT

IN 2009.

THE MAJORITY OF UNPRICED NATURAL CAPITAL COSTS ARE FROM GREENHOUSE GAS EMISSIONS (38%) FOLLOWED

BY WATER USE (25%); LAND USE (24%); AIR POLLUTION (7%), LAND

AND WATER POLLUTION (5%) AND

Trucost has undertaken this study on behalf of the TEEB for Business Coalition.1 Findings of this report build on TEEB’s The Economics of Ecosystems and Biodiversity in Business and Enterprise2 and the World Business Council for Sustainable Development’s Guide to Corporate Ecosystem Valuation3 by estimating in monetary terms the financial risk from unpriced natural capital inputs to production, across business sectors at a regional level. By using an environmentally extended input-output model (EEIO) (see Appendix 2), it also estimates, at a high level, how these may flow through global supply chains to producers of consumer goods. It demonstrates that some business activities do not generate sufficient profit to cover their natural resource use and pollution costs. However, businesses and investors can take account of natural capital costs in decision making to manage risk and gain competitive advantage.

WASTE (1%).

WASTE (1%).

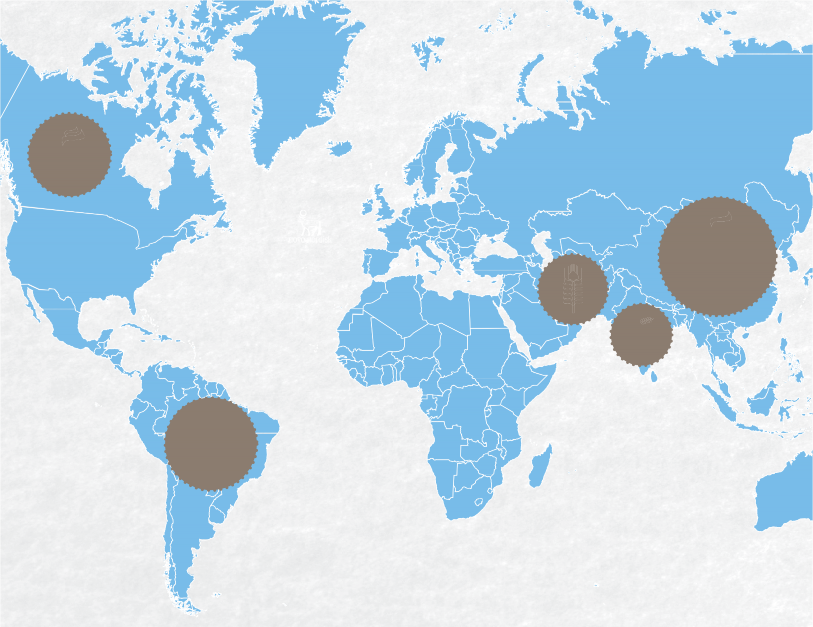

NO HIGH IMPACT REGION-SECTORS

GENERATE SUFFICIENT PROFIT TO COVER THEIR ENVIRONMENTAL

IMPACTS. SUBJECT TO ADAPTIVE CAPABILITIES, THIS WILL CAUSE THEM TO PASS ON THESE COSTS

TO CUSTOMERS. REGION-SECTORS

MOST AT RISK INCLUDE COAL

POWER GENERATION IN EASTERN ASIA AND NORTHERN AMERICA, WHEAT FARMING IN SOUTHERN ASIA, AND CATTLE RANCHING IN SOUTH AMERICA AND

SOUTHERN ASIA.

NO HIGH IMPACT REGION-SECTORS

GENERATE SUFFICIENT PROFIT TO COVER THEIR ENVIRONMENTAL

IMPACTS. SUBJECT TO ADAPTIVE CAPABILITIES, THIS WILL CAUSE THEM TO PASS ON THESE COSTS

TO CUSTOMERS. REGION-SECTORS

MOST AT RISK INCLUDE COAL

POWER GENERATION IN EASTERN ASIA AND NORTHERN AMERICA, WHEAT FARMING IN SOUTHERN ASIA, AND CATTLE RANCHING IN SOUTH AMERICA AND

SOUTHERN ASIA.

Natural capital assets fall into two categories: those which are non-renewable and traded, such as fossil fuel and mineral “commodities”; and those which provide finite renewable goods and services for which no price typically exists, such as clean air, groundwater and biodiversity. During the past decade commodity prices erased a century-long decline in real terms4, and risks are growing from over-exploitation of increasingly scarce, unpriced natural capital. Depletion of ecosystem goods and services, such as damages from climate change or land conversion, generates economic, social and

environmental externalities. Growing business demand for natural capital, and falling supply due to environmental degradation and events such as drought, are contributing to natural resource constraints, including water scarcity.

COMPANIES AND INVESTORS

CAN USE INFORMATION ON THE REGION-SECTORS THAT HAVE THE LARGEST NATURAL CAPITAL COSTS TO ASSESS THE POSSIBLE SCALE OF DIRECT, SUPPLY-CHAIN AND

INVESTMENT RISKS. REGIONAL AND SECTORAL VARIATIONS PRESENT

OPPORTUNITIES FOR BUSINESSES TO ENHANCE COMPETITIVE

ADVANTAGE, AND FOR INVESTORS

TO IMPROVE RELATIVE RETURNS.

COMPANIES AND INVESTORS

CAN USE INFORMATION ON THE REGION-SECTORS THAT HAVE THE LARGEST NATURAL CAPITAL COSTS TO ASSESS THE POSSIBLE SCALE OF DIRECT, SUPPLY-CHAIN AND

INVESTMENT RISKS. REGIONAL AND SECTORAL VARIATIONS PRESENT

OPPORTUNITIES FOR BUSINESSES TO ENHANCE COMPETITIVE

ADVANTAGE, AND FOR INVESTORS

TO IMPROVE RELATIVE RETURNS.

Government policies to address the challenge include environmental regulations and market-based instruments which may internalize natural capital costs and lower the profitability of polluting activities. In the absence of regulation, these costs usually remain externalized unless an event such as drought causes rapid internalization along supply-chains through commodity price volatility (although the costs arising from a drought will not necessarily be in proportion to the externality from any irrigation). Companies in many sectors are exposed to natural capital risks through their supply chains, especially where margins and pricing power are low. For example, Trucost’s analysis found that the profits of apparel retailers were impacted by up to 50% through cotton price volatility in recent years.5 Economy-wide, these risks are sufficiently large that the World Economic Forum cites ‘water supply crises’ and ‘failure of climate change adaptation’ along with several other environmental impacts among the most material risks facing the

global economy.6

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

This study monetizes the value of unpriced natural capital consumed by primary production (agriculture, forestry, fisheries, mining, oil and gas exploration, utilities) and some primary processing (cement, steel, pulp and paper, petrochemicals) (see Appendix 3) in the global economy through standard operating practices, excluding catastrophic events. For each sector in each region (region-sector), it estimates the natural capital cost broken down by six environmental key performance indicators (EKPIs), and a ranking of the top 100 costs is developed from this. It also estimates the 20 region-sectors with the highest combined impacts across all EKPIs to provide a platform

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 7

METHODOLOGY

AND LIMITATIONS

THE PROJECT METHODOLOGY ASSESSES THE IMPACT RATIO

(DIRECT ENVIRONMENTAL COST PER UNIT OF REVENUE) FOR

PRIMARY PRODUCTION AND

PRIMARY PROCESSING SECTORS.

COUNTRY-SPECIFIC PRODUCTION

DATA AND VALUATIONS WERE APPLIED. RESULTS WERE

AGGREGATED AT A REGIONAL LEVEL TO PRODUCE A “GLOBAL 100

RANKING” IDENTIFYING THE TOP 100 EXTERNALITIES FOR EACH EKPI BY REGION-SECTOR AND A “GLOBAL 20 RANKING” OF THE TOP 20 REGION-SECTOR IMPACTS ACROSS ALL EKPIs.

TRUCOST’S 532 SECTOR EEIO

MODEL WAS USED TO COMBINE

DIRECT AND INDIRECT COSTS, AND HENCE ESTIMATE AT A HIGH LEVEL WHICH SECTORS AND COMPANIES ARE SIGNIFICANTLY EXPOSED TO

THE PRIMARY SECTOR IMPACTS THAT ARE UPSTREAM IN THEIR SUPPLY CHAINS.

THE REPORT PROVIDES A

TOP-DOWN VIEW OF GLOBAL

EXTERNALITIES BY SECTOR AT A REGIONAL LEVEL. IT DOES NOT CAPTURE INTRA-NATIONAL

DIFFERENCES OR DIFFERENCES BETWEEN SPECIFIC

TECHNOLOGIES OR BUSINESS

PRACTICES. THE RESULTS COULD BE STRENGTHENED BY BOTTOM-UP ANALYSIS AND THE USE OF

PRIMARY DATA, AS OPPOSED TO THE USE OF SECONDARY

VALUATIONS AND BENEFITS TRANSFER.

FURTHERMORE, THERE ARE UNCERTAINTIES IN BOTH

ECOLOGICAL SCIENCE AND THE VALUATION OF ECOSYSTEM

SERVICES.

THE ENVIRONMENTAL COSTS ARE ASSUMED TO BE WHOLLY

EXTERNAL. THE STUDY DOES NOT ATTEMPT TO IDENTIFY THE RATE

OF INTERNALIZATION OF NATURAL CAPITAL COSTS IN MARKET PRICES.

METHODOLOGY

AND LIMITATIONS

THE PROJECT METHODOLOGY ASSESSES THE IMPACT RATIO

(DIRECT ENVIRONMENTAL COST PER UNIT OF REVENUE) FOR

PRIMARY PRODUCTION AND

PRIMARY PROCESSING SECTORS.

COUNTRY-SPECIFIC PRODUCTION

DATA AND VALUATIONS WERE APPLIED. RESULTS WERE

AGGREGATED AT A REGIONAL LEVEL TO PRODUCE A “GLOBAL 100

RANKING” IDENTIFYING THE TOP 100 EXTERNALITIES FOR EACH EKPI BY REGION-SECTOR AND A “GLOBAL 20 RANKING” OF THE TOP 20 REGION-SECTOR IMPACTS ACROSS ALL EKPIs.

TRUCOST’S 532 SECTOR EEIO

MODEL WAS USED TO COMBINE

DIRECT AND INDIRECT COSTS, AND HENCE ESTIMATE AT A HIGH LEVEL WHICH SECTORS AND COMPANIES ARE SIGNIFICANTLY EXPOSED TO

THE PRIMARY SECTOR IMPACTS THAT ARE UPSTREAM IN THEIR SUPPLY CHAINS.

THE REPORT PROVIDES A

TOP-DOWN VIEW OF GLOBAL

EXTERNALITIES BY SECTOR AT A REGIONAL LEVEL. IT DOES NOT CAPTURE INTRA-NATIONAL

DIFFERENCES OR DIFFERENCES BETWEEN SPECIFIC

TECHNOLOGIES OR BUSINESS

PRACTICES. THE RESULTS COULD BE STRENGTHENED BY BOTTOM-UP ANALYSIS AND THE USE OF

PRIMARY DATA, AS OPPOSED TO THE USE OF SECONDARY

VALUATIONS AND BENEFITS TRANSFER.

FURTHERMORE, THERE ARE UNCERTAINTIES IN BOTH

ECOLOGICAL SCIENCE AND THE VALUATION OF ECOSYSTEM

SERVICES.

THE ENVIRONMENTAL COSTS ARE ASSUMED TO BE WHOLLY

EXTERNAL. THE STUDY DOES NOT ATTEMPT TO IDENTIFY THE RATE

OF INTERNALIZATION OF NATURAL CAPITAL COSTS IN MARKET PRICES.

for companies to begin to assess exposure to unpriced natural capital, both directly and through supply chains. In doing so it allows investors to consider how their assets may be exposed. It also highlights sector-level variation in regional exposure to impacts to identify opportunities to enhance competitive advantage. It does not attempt to assess the rate at which these costs may

be internalized, and whether sectors are able to adapt, but attempts to give a high-level view of where natural capital risk lies, and what this could mean for business profitability in a more sustainable regulatory environment.

MEASURING AND VALUING IMPACTS

Trucost assessed more than 100 direct environmental impacts (see Appendix

4) and condensed them into six EKPIs to cover the major categories of unpriced natural capital consumption: water use, greenhouse gas (GHG) emissions, waste, air pollution, land and water pollution, and land use. These EKPIs are estimated by region across the primary production and primary processing sectors (see Appendix 3). How these impacts are embedded in the products of downstream sectors was estimated using Trucost’s EEIO (see Appendix 2). Double counting of impacts was limited by differentiating between the consumption of ecosystem services (land and water use), and pollution impacts on the supply of these ecosystem services and human health (GHGs and other pollutants). The magnitude of each impact per unit of revenue varies by region due to factors such as differences in production intensity and resource efficiency.

Trucost’s valuation of environmental impacts estimates the value of a natural good or service in the absence of a market price to allow direct comparison with financial performance and appraisal of potential profit at risk. This approach provides insight into exposure to an increase in the private cost of natural capital following internalization. Valuations were derived from academic journals, government studies, and established environmental economic techniques. Trucost applied the social environmental cost to quantities of each impact, except for nutrient pollution of water and hazardous waste where the abatement cost was used. Marginal costs are used except for land use where the mean value is used. This reflects the assumption that business risk and responsibility today for water use and pollution relates to the marginal unit used/emitted, whereas for land use, conversion from its natural state has occurred more steadily over a far longer period of time.

THE RANKINGS

Trucost’s analysis has estimated the unpriced natural capital costs at US$7.3

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

trillion relating to land use, water consumption, GHG emissions, air pollution, land and water pollution, and waste for over 1,000 global primary production and primary processing region-sectors under standard operating practices, excluding unpredictable catastrophic events. This equates to 13% of global economic output in 2009. Risk to business overall would be higher if all upstream sector impacts were included. All impacts are in 2009 prices and reflect 2009 product quantities, the latest year for which comprehensive data were available.

8

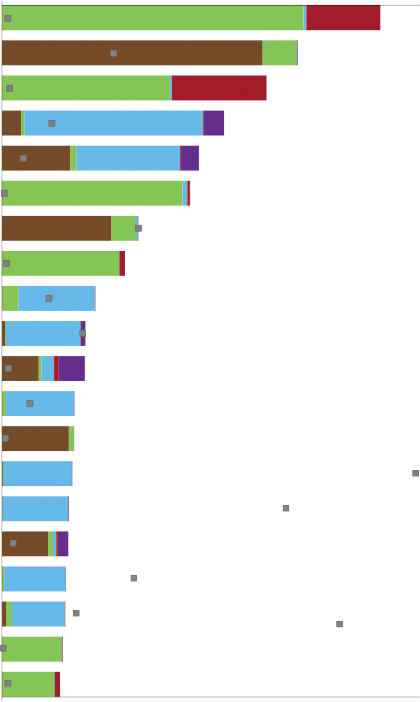

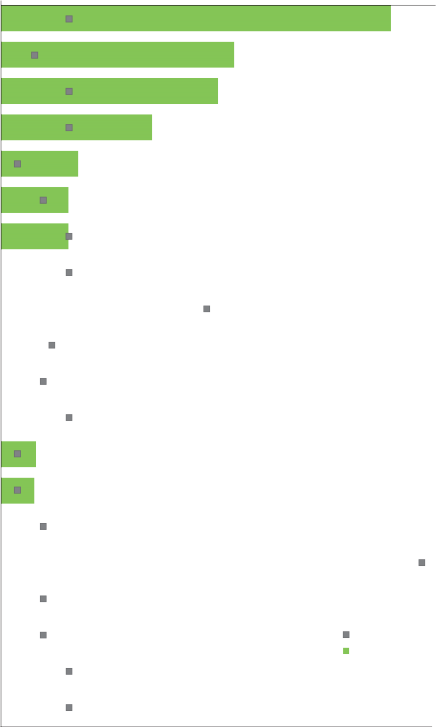

THE GLOBAL 100 EXTERNALITIES

The region-sector impacts were combined to rank the top 100 environmental impacts globally (see Table 1 for the top 5 impacts). The value of the Global 100 externalities is estimated at US$4.7 trillion or 65% of the total primary sector impacts identified. GHGs from coal power generation in Eastern Asia contribute the largest environmental impact, followed by land use linked to cattle farming in South America. The most significant impacts making up the US$4.7 trillion are GHGs (36%), water use (26%) and land use (25%).

TABLE 1: RANKING OF THE 5 REGION-SECTORS BY EKPI WITH THE GREATEST IMPACT ACROSS ALL EKPIs WHEN MEASURED IN MONETARY TERMS

RANK | IMPACT | SECTOR | REGION | NATURAL CAPITAL COST, $BN | REVENUE, $BN | IMPACT RATIO |

1 | GHG | COAL POWER GENERATION | EASTERN ASIA | 361.0 | 443.1 | 0.8 |

2 | LAND USE | CATTLE RANCHING AND FARMING | SOUTH AMERICA | 312.1 | 16.6 | 18.7 |

3 | GHG | IRON AND STEEL MILLS | EASTERN ASIA | 216.1 | 604.7 | 0.4 |

4 | WATER | WHEAT FARMING | SOUTHERN ASIA | 214.4 | 31.8 | 6.7 |

5 | GHG | COAL POWER GENERATION | NORTHERN AMERICA | 201.0 | 246.7 | 0.8 |

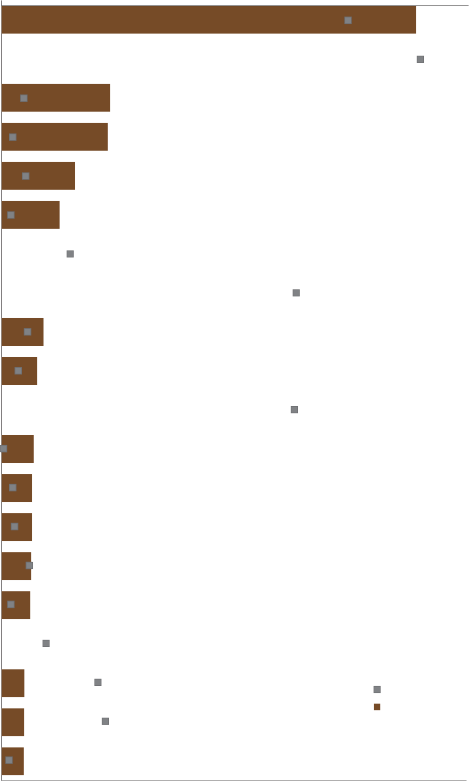

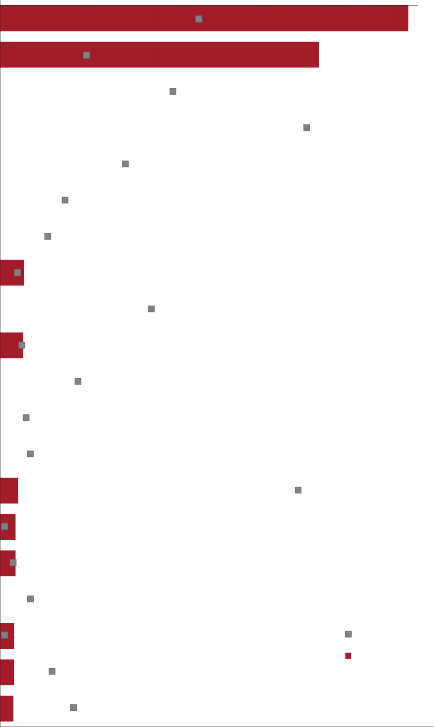

THE GLOBAL 20 REGION-SECTORS

Impacts across all six EKPIs were combined by region and sector to create a ranking of the top region-sectors globally. Combining the six EKPIs in this way is not intended to imply that the different EKPIs can be traded-off against each other. Across regions, the results are sensitive to the scale of production as well as the environmental cost per unit of revenue (impact ratio). Meanwhile across EKPIs, the results are sensitive to the relative value placed on them.

The impact of the Global 20 region-sectors is estimated at US$3.2 trillion or 43% of the total primary production and primary processing sector impacts identified by this study, emphasizing their concentration. The highest-impact region-sectors globally are shown in Table 2 below. Coal power generation in Eastern Asia is the highest-impact sector globally, the third highest is coal power generation in North America. The other highest-impact sectors are agriculture, in areas of water scarcity, and where the level of production and therefore land use is also high. Natural capital costs were lower than output in just five of the 20 region-sectors, and higher than average sector profits in all

cases.7 The extent to which agricultural sectors globally do not generate enough revenue to cover their environmental damage is particularly striking from a risk perspective. The impact is many multiples of profit in all cases.

TABLE 2: RANKING OF THE 5 REGION-SECTORS WITH THE GREATEST OVERALL NATURAL CAPITAL IMPACT

RANK | SECTOR | REGION | NATURAL CAPITAL COST, $BN | REVENUE, $BN | IMPACT RATIO |

1 | COAL POWER GENERATION | EASTERN ASIA | 452.8 | 443.1 | 1.0 |

2 | CATTLE RANCHING AND FARMING | SOUTH AMERICA | 353.8 | 16.6 | 18.8 |

3 | COAL POWER GENERATION | NORTHERN AMERICA | 316.8 | 246.7 | 1.3 |

4 | WHEAT FARMING | SOUTHERN ASIA | 266.6 | 31.8 | 8.4 |

5 | RICE FARMING | SOUTHERN ASIA | 235.6 | 65.8 | 3.6 |

![]()

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 9

RANKING BY IMPACT, SECTOR AND REGION

LAND USE

The global natural capital cost of land use by the primary production and primary processing sectors analyzed in this study is estimated at US$1.8 trillion. The top 100 region-sectors (less than 10% of the total by number) accounted for 84% of the impact. Agriculture sectors, in particular cattle ranching, have the greatest impact. Due to both magnitude of land use for cattle ranching in Brazil, and the high value of ecosystem services of the virgin land used, the impact of cattle ranching in South America is especially high.

Land provides social benefits in the form of ecosystem services. Some of these are lost when land is converted to industrial production. Land use was valued according to its location identified using sector production data and geographic information system data. The United Nations’ Millennium Ecosystem Assessment8 identified 24 ecosystem services, classified as provisioning, regulating, cultural or supporting. Each unit of service has a value depending on its specific location, and each ecosystem provides a different set and scale of ecosystem services per unit area. The set and scale of these services were applied per unit of area. Country values were aggregated at a regional level to develop a list of the top 20 region-sector land use impacts.

WATER CONSUMPTION

The global natural capital cost of water consumption by the primary production and primary processing sectors analyzed in this study is estimated at US$1.9 trillion. The top 100 region-sectors accounted for 92% of these costs, which are concentrated in agriculture and water supply. Water that is directly abstracted from surface or groundwater is rarely paid for adequately if at all, and its substantial value to society varies according to its regional scarcity. Abstracted water was valued according to national water availability. Rates of water use take into account national irrigation rates for agriculture, which is responsible for the vast majority of global water use, and local recycling rates and distribution losses for the water supply sector. The volume of water use by country-sector was valued by applying national water valuations to calculate the social cost of water consumption. Resulting values for water use were aggregated to create a ranking of the top 20 water consuming region-sectors in terms of social cost. Water costs were significant for several sectors in Asian regions and Northern Africa.

GREENHOUSE GASES

The global natural capital cost of GHG emissions by the primary production and primary processing sectors analyzed in this study is estimated at US$2.7 trillion. The top 100 region-sectors account for 87% of these costs. Impacts are dominated by thermal power production, steel and cement manufacturing, fugitive methane emissions and flaring at oil and gas wells, and energy required to supply and treat water. Coal power impacts are high in regions with signifi- cant electricity production and where coal has a large share of the grid mix, such as Eastern Asia and North America.

Livestock emissions are also significant.

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

GHG emissions are linked to climate change impacts including reduced crop yields, flooding, disease, acidification of oceans and biodiversity loss. The timing, magnitude, economic and social cost of these are modeled under scenarios and linked to concentrations of carbon dioxide in the atmosphere to estimate the marginal cost of each metric ton of carbon dioxide and other GHGs, measured in carbon dioxide equivalents (CO2e) and adjusted for their global warming potentials. A social cost of US$106 per metric ton of CO2e was used, which is the value identified in the UK Government’s Stern report adjusted for inflation to 2009 prices.9 A ranking of the top 20 region-sectors with the highest GHG impacts was created by multiplying each metric ton of CO2e emissions by US$106. This is higher than the cost of abatement in most cases and therefore the financial risk to business overall is likely to be less than this estimate.

AIR POLLUTION

The global cost of air pollution by the primary production and primary processing sectors analyzed in this study is estimated at US$0.5 trillion. The top 100 region-sectors accounted for 81% of these impacts. Sulfur dioxide, nitrogen oxides and particulate emissions from fossil fuel combustion dominate these costs. Regions with the greatest output

10

from energy-intensive sectors have the highest air pollution costs. 42% of global costs for air pollution from primary sectors are due to coal power generation in Northern America, Eastern Asia and Western Europe.

Air pollutants can damage human health, buildings, and crop and forest yields. The economic damage caused per unit of pollutant depends on the specific location, and is driven by population, infrastructure, and crop and forest density. The social costs of air pollution damage were developed for each country based on the impact on human health, infrastructure, crops and forests. These were then applied to the levels of each air pollutant by country-sector which were then aggregated to create a ranking of the top 20 region-sectors with the greatest air pollution costs.

LAND AND WATER POLLUTION

The global land and water pollution impact by the primary production and primary processing sectors analyzed in this study is estimated at US$0.3 trillion and the top 100 region-sectors accounted for 86% of this. Water pollution costs are dominated by the impact of eutrophication from phosphate and nitrate fertilizers. These are concentrated in global grain production, especially in Asia where volumes are large, and North America and Europe where fertilizer application rates are also higher.

Land and water pollution impacts can be local in the form of polluted water sources which generate abatement costs and harm human health, and can also be remote in the form of ocean dead zones which reduce biodiversity and undermine fisheries. Valuations for nitrate and phosphate pollution were derived from the cost of nutrient removal by water treatment companies. For heavy metals the impact on human health was used. By applying the land and water pollution emissions factors to sector outputs, a ranking was developed for the top 20 region-sectors with the highest levels of land and water pollution.

WASTE

The global waste impact by the primary production and primary processing sectors analyzed in this study is estimated at just under US$50 billion and the top 100 region-sectors accounted for 99% of the total. Waste impacts are the least significant of the EKPIs, and are concentrated in nuclear power generation in North America, followed by Western Europe, Eastern Asia and Eastern Europe. Waste can be split into three broad categories: hazardous waste, non-hazardous waste, and nuclear waste. Given the nature of the sectors analyzed in this study, the focus is on hazardous and nuclear waste. The social cost of nuclear waste has been derived from academic studies on the damage caused and referenced against relevant taxes. A single value has then been applied globally per MWh nuclear output in each country. Hazardous waste valuations have been derived from the cost of abatement. By applying the waste factors to sector output, a ranking was developed for the top 20 country-sectors with the greatest waste impacts.

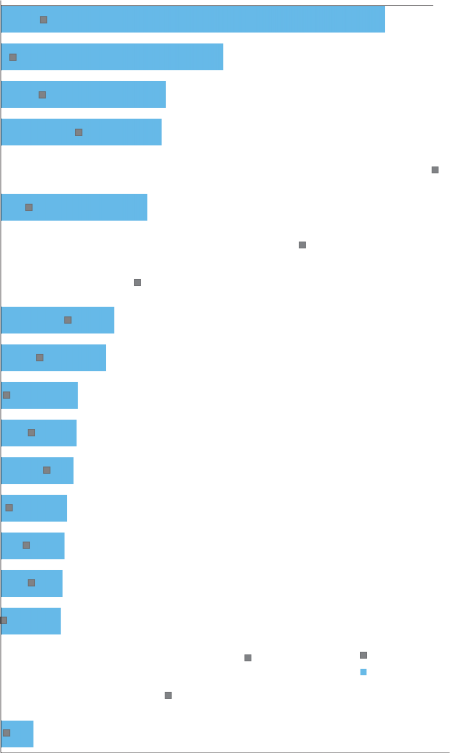

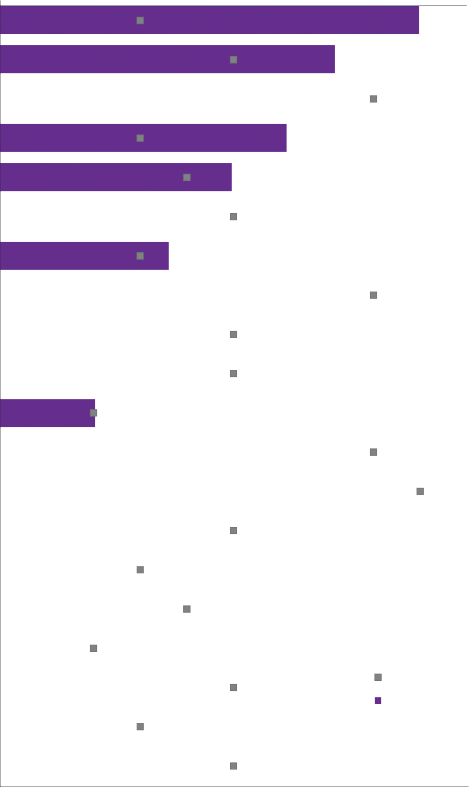

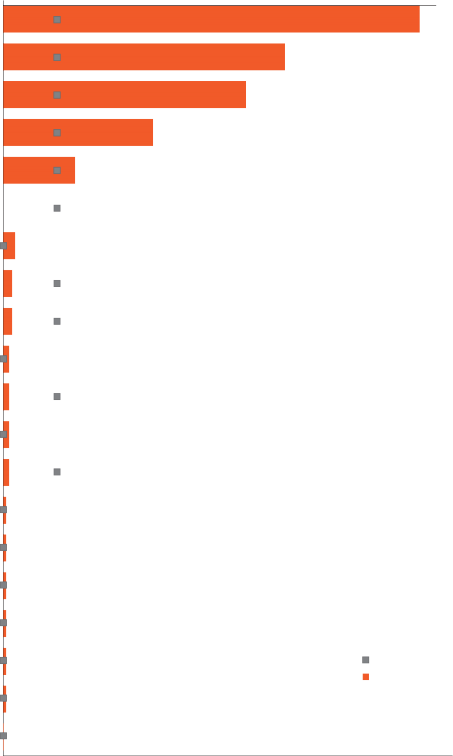

CONSUMER SECTORS DRIVE NATURAL CAPITAL COSTS

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

Food and timber processing, as well as leather and hide tanning, are the sectors most at risk from these costs being passed through supply chains. This was estimated using Trucost’s EEIO model (see Appendix 2) which maps the flow of goods and services, and associated environmental impacts, through the economy. The ability of companies in these downstream sectors to pass on natural capital costs will vary according to pricing power. The 10 sectors with the greatest overall impacts (direct impacts from their own operations plus indirect impacts flowing along the supply chain), which also have at least half of these estimated to be in their supply chains, are all involved in food production and processing. Sectors ranging from soybean and animal processing to fats and oils refining and animal production are especially exposed to land and water use.

While the location of operations and supply chains plays a role in the specific country of impact, consuming companies in developed markets often purchase from developing countries where impacts may be high. Therefore they, and their consumers, are responsible for and at risk from impacts in other regions. Even a company that buys a product from a low-impact producer but where globally impacts for that product are high, is at risk from pass through of costs unless forward prices have been agreed. Therefore companies may benefit from building long-term

relationships with their suppliers to improve environmental performance and reduce both of their financial risks. Some companies have recognized this and are already taking action to increase their long term social and financial sustainability.

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 11

TABLE 3: TOP 5 SECTORS WITH THE GREATEST OVERALL IMPACT AND AT LEAST 50% OF IMPACTS IN THEIR

SUPPLY-CHAIN

RANK | SECTOR | TOTAL DIRECT AND INDIRECT COSTS PER US$ MN OUTPUT (US$MN) | INDIRECT IMPACT AS A MULTIPLE OF DIRECT IMPACT |

1 | SOYBEAN AND OTHER OILSEED PROCESSING | 1.52 | 154 |

2 | ANIMAL (EXCEPT POULTRY) SLAUGHTERING, RENDERING, AND PROCESSING | 1.48 | 108 |

3 | POULTRY PROCESSING | 1.45 | 98 |

4 | WET CORN MILLING | 1.32 | 80 |

5 | BEET SUGAR MANUFACTURING | 1.29 | 86 |

Companies can identify opportunities in their supply chains by considering the distribution of unpriced natural capital relative to revenue and profits. Strategic as well as shorter-term investors should understand the extent to which companies are addressing these risks and are able to adapt in the future. Returns can be optimized through companies managing upstream exposure to these risks, which are already the most significant driver of some raw materials prices. These in turn are the most volatile component of many companies’ costs.

SO WHAT DOES THIS MEAN?

No high impact region-sectors generate sufficient profit to cover their environmental impacts. Therefore if unpriced natural capital costs are internalized, a large proportion would have to be passed on to consumers. The risk to agricultural commodity prices is particularly striking, where the natural capital cost is universally higher than the revenue of the sectors. However, within sectors, there is significant variation between countries based on energy mix, yields (impacting land use), fertilizer and irrigation rates.

The scale and variation in impacts provides opportunities for companies and their investors to differentiate themselves by optimizing their activities and those of their suppliers. As the recent U.S. drought shows, these impacts are likely to be increasingly internalized to producers and consumers through environmental events. Therefore those companies that align business models with the sustainable use of natural capital on which they depend should achieve competitive advantage from greater resilience, reduced costs and improved security of supply.

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

12

RECOMMENDATIONS

RECOMMENDATIONS FOR COMPANIES

Focus on gathering primary impact data, and conducting primary environmental valuation studies, on likely hot spots in direct operations and in supply chains.

Identify existing mechanisms that could internalize natural capital costs and the probability and financial impact of these costs being internalized in the future.

Consider using valuations for EKPIs to apply “shadow” pricing in procurement decision-making and financial analyzes.

Explore opportunities for adaptation and to improve resource efficiency, both internally and within the supply chain.

Evaluate options to change suppliers, sourcing location or materials, where existing suppliers are not willing to change.

RECOMMENDATIONS FOR INVESTORS

Identify which assets are most exposed to natural capital risk, and which companies and governments are able and willing to adapt.

Identify the probability and impact of natural capital costs being internalized.

Build natural capital risks, adjusted for the likelihood of internalization, into asset appraisal and portfolio risk models.

RECOMMENDATIONS FOR GOVERNMENTS

Identify the distribution of natural capital risk across the economy, and look for hot spots of low natural capital productivity.

Understand how business sectors’ global competitive position may change in the future as a result of natural capital costs.

Develop policies that efficiently and effectively internalize these costs, avoiding sudden shocks in the future, and helping businesses to position themselves for a natural capital

constrained world.

RECOMMENDATIONS FOR TEEB FOR BUSINESS COALITION

EXECUTIVE SUMMARY

EXECUTIVE SUMMARY

Coordinate business and investor collaborations to support uptake of the recommendations above.

In particular, develop frameworks for companies and investors to apply standardized, systematic approaches to valuing the impacts of natural resource use and pollution based on standards consistent with the UN System of Environmental-Economic Accounting.10

Facilitate dialogue between companies, investors and governments on natural capital risk.

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 13

The value of nature is increasingly visible as business demand for natural capital grows. This demand can cause environmental events and phenomena such as water scarcity, directly linked to lower profitability. Indirect effects can include social pressure that prompts changes in demand and regulation, with little or no warning.

This study builds on The Economics of Ecosystems and Biodiversity in Business and Enterprise2 and the World Business Council for Sustainable Development’s Guide to Corporate Ecosystem Valuation3 by estimating in monetary terms the financial risk from natural capital that is currently unpriced, across specific business sectors at a regional

level, and through supply chains. It demonstrates that opportunities from sustainable business practices can be private as well as collective, and therefore how, by taking pre-emptive action, businesses may gain a competitive advantage while meeting corporate sustainability goals.

In doing so, the study is also a tool for investors to understand the scale and distribution of natural capital risk across their portfolios; how this has, and may continue to become financial risk; and how this can be mitigated through informed asset selection.

WHY NOW?

Natural capital assets fall into two broad categories: Those which are non-renewable and traded, such as fossil fuel and mineral “commodities”; and those which provide ecosystem services (renewable goods and services)8, and for which no price typically exists, such as groundwater, biodiversity and pristine forests. Over the last decade commodity prices erased a century-long decline in real terms4; however they generally remain below their 2008 peak . This pause in commodity price rises masks the growing risk to business from increasingly scarce unpriced natural capital. Although typically renewable, like traded resources natural resources are also finite, and their consumption generates

economic externalities.

In the absence of forward-looking regulation, the costs usually remain externalized for extended periods unless some event such as a drought causes rapid internalization through, for example, a spike in grain prices. Two significant incidents last summer highlighted risk from natural capital dependency. Firstly, drought in the U.S. has impacted corn and soybean production. Reinsurance company Munich Re reported that crop losses have been US$20 billion.11 However, effects on the global economy from higher prices will be much greater. Most of the effects of rising costs for food supply inputs such as animal feed will filter through in retail food prices in 2013.12 Trucost estimates13 the annualized cost to consumers of grains and oilseeds at over US$50 billion by comparing prices before and after the drought. Secondary social impacts such as increased food poverty would increase this estimate further. Secondly, a two-day power outage in India in July 2012 affected half the country’s population. The disruption was caused in part by a lack of rain which forced farmers to pump additional water for irrigation.14 While the immediate cost may be less than 1% of GDP (currently US$1.848 trillion15), the impact on future investment may be substantially higher. Although these droughts are not directly a result of natural capital depletion, they demonstrate the increasing dependence on irrigation, and pressure on increasingly scarce water resources.16 This comes at a time of declining crop inventories and rising demand over the past decade17, and for the foreseeable future.

BACKGROUND

BACKGROUND

Trucost research18 for the United Nations’ Environment Programme Finance Initiative and UN-backed Principles for Responsible Investment estimated that the world’s 3,000 largest publicly-traded companies caused US$2.15 trillion of environmental damage in 2008. It also showed that companies in downstream sectors as well as those operating in primary industries can be at risk from environmental impacts, and this is especially true where margins and pricing power are low. Finally, the World Economic Forum’s Global Risks 2013 report identifies water supply crises, food shortage crises, extreme volatility in energy and agricultural prices, rising greenhouse gas emissions and failure of climate change adaptation among the top 10 global risks over the next 10 years, as measured by likelihood and scale of global impact.

Companies are pre-empting the risk of disorderly internalization, whether this is securing their licences to operate by reducing their impacts on ecosystem services19, reducing their net consumption of ecosystem services20, or developing products that help others to achieve this.21

14

OUTPUTS AND APPLICATION

This study estimates in monetary terms the value of unpriced natural capital that is consumed by primary production in the global economy (agriculture, forestry, fisheries, mining, oil and gas exploration, utilities) and some primary processing including cement, steel, pulp and paper, and petrochemicals. This value is based on the environmental impacts of prevailing standard operating practices and excludes catastrophic events such as the Deepwater Horizon oil spill in the Gulf of Mexico in 2010 or the Fukushima nuclear disaster in Japan in 2011.

The analysis allocates over 80% of businesses direct environmental impacts by value22 to specific sectors at a

sub-continental regional level (“region-sectors”) as defined by the United Nations (see Appendix 5)23, broken down by EKPI. It then ranks the top 100 region-sector impacts by individual EKPI overall, and identifies the top 20 region-sector combined impacts across all EKPIs. This aims to provide a platform from which companies can begin to appraise and engage with internal divisions and their supply chains, and investors can analyze their assets.

The study also highlights the greatest regional variations in impacts for specific sectors to help companies and investors to identify the greatest opportunities to enhance competitive advantage.

MEASURING IMPACTS

DIRECT ENVIRONMENTAL IMPACTS

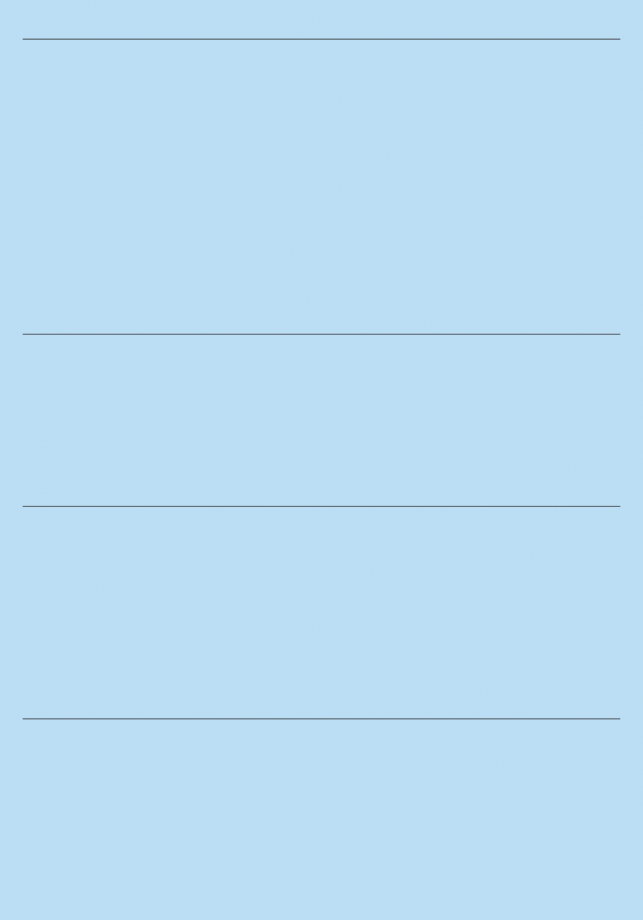

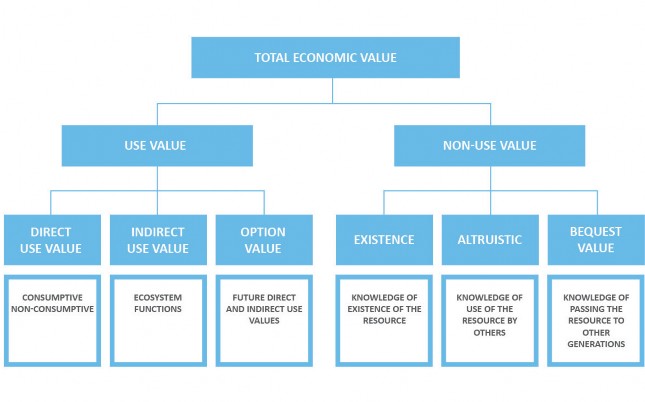

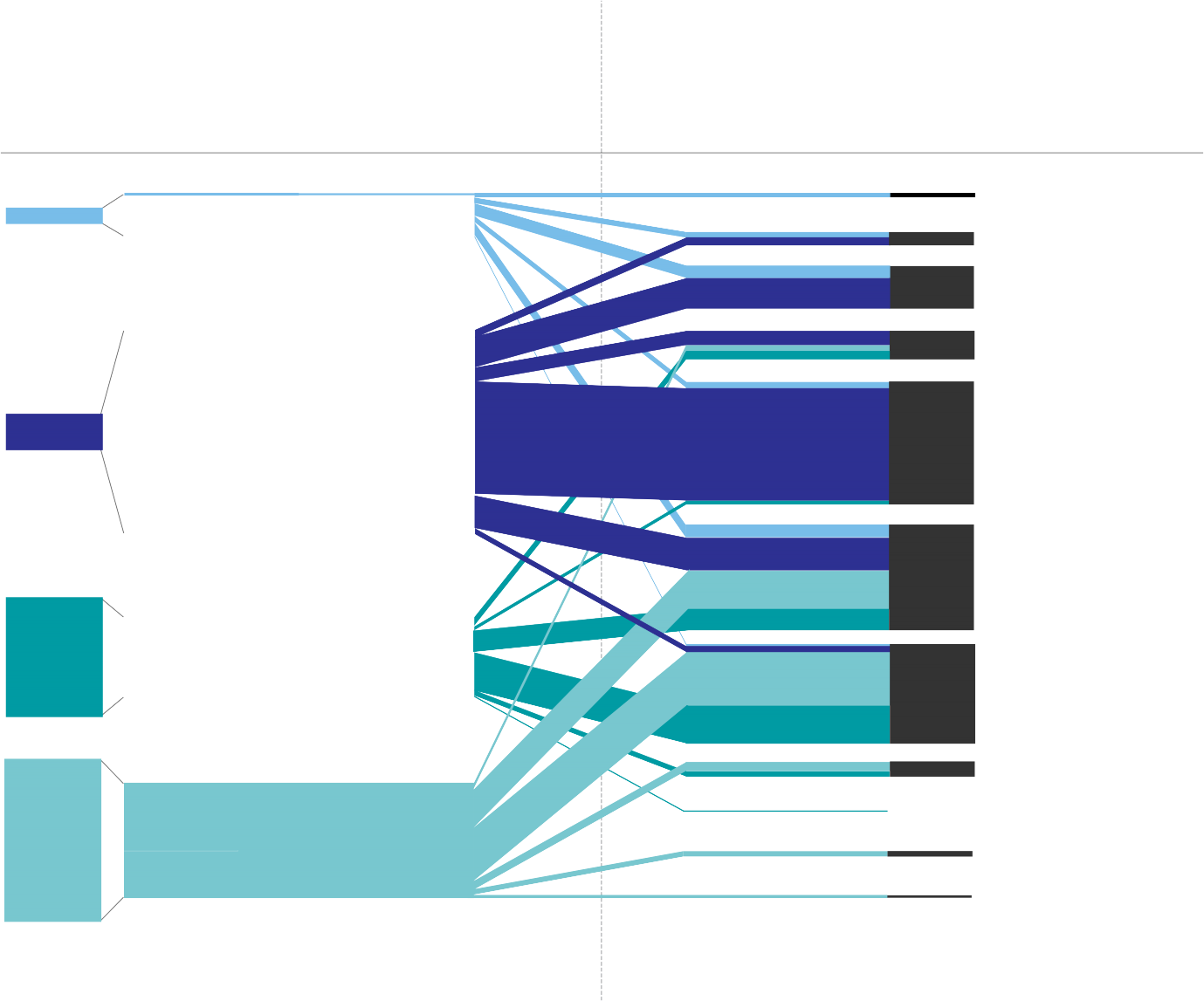

Direct environmental impacts are those produced by a company’s own operations, whereas indirect impacts are from sources upstream in supply chains or downstream from product use or disposal or investments. Trucost has been gathering data on company and sector environmental impacts from reports, academic literature, governments and supra-national initiatives for 12 years. Trucost’s database covers over 100 environmental impacts (see Appendix 4) which are condensed into six high-level EKPIs covering the major categories of unpriced natural capital consumption. These are water use, greenhouse gas emissions (GHGs), waste, air pollution, land and water pollution, and land use, and are estimated across over 500 business sectors. The first five result from the consumption or degradation of ecosystem goods and services and direct impacts on humans and the economy. Land use is solely the degradation of ecosystems themselves, and therefore the ability of a piece of land to provide goods and services in the future (see Figure 1). By differentiating between provision and consumption, double-counting of impacts is limited. For example, conversion of rainforest to farmland significantly reduces an area of land’s carbon sequestration potential, while agricultural production also creates GHGs which increases demand for remaining carbon sequestration services.

Trucost is able to normalize impacts by revenue. For example water use, GHG emissions and land use are expressed as m3, metric tons and hectares respectively per US$mn of revenue. The significance of each EKPI will differ for each sector. For example, GHGs and air pollution are most significant for the electric power sector; land and water use for agriculture; and waste for nuclear power generation.

Crucially, the magnitude of the impact per unit of revenue can vary from one region to the next, within the same sectors. GHGs from purchased electricity will depend on the national grid energy mix and levels of irrigation vary significantly by region as well as by crop – irrigation of cotton in Pakistan is 120 times more intensive than irrigation of cotton in Brazil, for example.24 These regional variations are even more significant when combined with regional environmental valuation differences, and this has significant implications for supply-chain optimization,

resource-efficient business models and companies maximizing their competitive advantage for the future.

![]()

BACKGROUND

BACKGROUND

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 15

FIGURE 1: THE INTERACTION OF ECOSYTEM SERVICES, POLLUTION AND THE ECONOMY

BACKGROUND

BACKGROUND

ECOSYSTEMS THE ECONOMY

16

ECOSYSTEM SERVICES

FROM LAND FROM WATER

POLLUTANTS

GHGs

AIR POLLUTANTS

LAND & WATER POLLUTANTS

WASTE

ECOSYSTEM SERVICES

FROM LAND FROM WATER

POLLUTANTS

GHGs

AIR POLLUTANTS

LAND & WATER POLLUTANTS

WASTE

BACKGROUND

BACKGROUND

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 17

INTERNALIZING

ENVIRONMENTAL COSTS

COMPANIES CAN INCUR SOME NATURAL CAPITAL COSTS THROUGH COMPLIANCE WITH REGULATIONS THAT SET

ENVIRONMENTAL PERFORMANCE STANDARDS AND POLLUTION

ABATEMENT RULES. COSTS CAN ALSO BE INTERNALIZED THROUGH

MARKET-BASED INSTRUMENTS SUCH

AS CAP-AND-TRADE PROGRAMMES AND

TAXES. WASTE IS ONE AREA WHERE TAXES ARE WIDELY APPLIED IN

DEVELOPED COUNTRIES.

THE LEVEL OF COSTS INTERNALIZED IS GENERALLY NEGLIGIBLE

COMPARED TO THE POLLUTION AND ECOSYSTEM SERVICE USE.

EXAMPLES OF THE DISCREPANCY

BETWEEN EXTERNAL COSTS AND THEIR CURRENT RATE OF

INTERNALIZATION INCLUDE:

ALLOWANCES FOR CARBON

DIOXIDE EMISSIONS UNDER THE EUROPEAN UNION EMISSIONS

TRADING SYSTEM ARE CURRENTLY TRADING AT LESS THAN €4 (US$6) PER METRIC TON, COMPARED

WITH THE ESTIMATED SOCIAL

COST OF US$106/TON. FOSSIL FUEL SUBSIDIES TOTALLING MORE THAN US$55 BILLION ANNUALLY IN OECD COUNTRIES EFFECTIVELY SUPPORT EMISSIONS.30

UNDER THE U.S. ENVIRONMENTAL PROTECTION AGENCY’S ACID RAIN PROGRAM, SULFUR DIOXIDE

ALLOWANCES FOR 2012 WERE

TRADING AT LESS THAN US$1 PER TON. TRUCOST ESTIMATES THE

SOCIAL COST OF EMISSIONS AT

BETWEEN US$538-US$2,354/TON.

GIVEN THE LACK OF MATERIALITY, TAXES AND TRADABLE PERMIT COSTS HAVE

NOT BEEN SUBTRACTED FROM THE ESTIMATED SOCIAL COSTS IN

THIS STUDY.

INTERNALIZING

ENVIRONMENTAL COSTS

COMPANIES CAN INCUR SOME NATURAL CAPITAL COSTS THROUGH COMPLIANCE WITH REGULATIONS THAT SET

ENVIRONMENTAL PERFORMANCE STANDARDS AND POLLUTION

ABATEMENT RULES. COSTS CAN ALSO BE INTERNALIZED THROUGH

MARKET-BASED INSTRUMENTS SUCH

AS CAP-AND-TRADE PROGRAMMES AND

TAXES. WASTE IS ONE AREA WHERE TAXES ARE WIDELY APPLIED IN

DEVELOPED COUNTRIES.

THE LEVEL OF COSTS INTERNALIZED IS GENERALLY NEGLIGIBLE

COMPARED TO THE POLLUTION AND ECOSYSTEM SERVICE USE.

EXAMPLES OF THE DISCREPANCY

BETWEEN EXTERNAL COSTS AND THEIR CURRENT RATE OF

INTERNALIZATION INCLUDE:

ALLOWANCES FOR CARBON

DIOXIDE EMISSIONS UNDER THE EUROPEAN UNION EMISSIONS

TRADING SYSTEM ARE CURRENTLY TRADING AT LESS THAN €4 (US$6) PER METRIC TON, COMPARED

WITH THE ESTIMATED SOCIAL

COST OF US$106/TON. FOSSIL FUEL SUBSIDIES TOTALLING MORE THAN US$55 BILLION ANNUALLY IN OECD COUNTRIES EFFECTIVELY SUPPORT EMISSIONS.30

UNDER THE U.S. ENVIRONMENTAL PROTECTION AGENCY’S ACID RAIN PROGRAM, SULFUR DIOXIDE

ALLOWANCES FOR 2012 WERE

TRADING AT LESS THAN US$1 PER TON. TRUCOST ESTIMATES THE

SOCIAL COST OF EMISSIONS AT

BETWEEN US$538-US$2,354/TON.

GIVEN THE LACK OF MATERIALITY, TAXES AND TRADABLE PERMIT COSTS HAVE

NOT BEEN SUBTRACTED FROM THE ESTIMATED SOCIAL COSTS IN

THIS STUDY.

VALUATION

Environmental, or natural capital, valuation estimates the value of a natu- ral good or service in the absence of a market price. This enables a direct comparison with financial performance and appraisal of profits at risk.

Credit and profit risk assessments can use these valuations as a proxy for exposure to an increase in the private cost of natural capital due to internalization, scarcity, or both.

Valuations can reflect a social cost, an external cost (social cost net of taxes), or an abatement cost. Social costs include the indirect costs of production that are not borne by polluters, and therefore not passed on to the end user of the goods produced25, but often incurred by other businesses and society at large through, for example, lost amenities, health impacts and insurance costs. The external cost of using a factor of production is the resulting loss which is suffered elsewhere.26 Valuations aim to overcome

this form of “market failure” to yield more efficient outcomes overall. Social costs can be used to assess the contribution of ecosystems to human

well-being, to inform decision-making, and to evaluate the consequences of alternative actions.27 In this study we have used the social cost, except nutrient pollution of water, and hazardous waste, where the abatement cost is used.

The numerous environmental valuations techniques to estimate social cost can be grouped by general methodology. These groups are revealed preference methods, stated preferences methods, and cost-based methods. Revealed preference and cost-based methods are grounded in mainstream economics since they rely on market price data to inform valuations.

Examples include hedonic pricing to explore the effect of proximity to a landfill site on house prices (a revealed preference method) and the cost of lost pollination from bees due to pesticide use (a cost-based method). Stated preference methods are more controversial since they use techniques to elicit individuals’ willingness to pay for a good or service

which they may not actually use. However, they have gained credence since contingent valuation was used to extend Exxon’s liability for damage caused by the Valdez oil spill in Alaska in 1989 beyond simply the clean-up costs and damage to local business such as fisheries.28

Trucost uses over 1,000 environmental valuations identified in peer- reviewed journals, as well as government studies. The way in which these are applied depends on the EKPI. GHGs for example, have the same impact wherever they are emitted. Values for other pollutants, water use and waste depend on local biophysical and human geography, and require a technique called benefits transfer29 to apply a value estimated in one location to another. By understanding the underlying factors (benefits) that drive an environmental value and the frequency of each factor in each location, a value estimated in one location can be applied to another. For example, air pollution has a negative impact on human health, crop yields and forests.

BACKGROUND

BACKGROUND

Therefore a value per unit of air pollution can be estimated by understanding the impact (known as dose response) on these factors, the damage cost per unit, and the density of each factor. In this study, the values for water, air pollution and land use were region-specific while other valuations are based on global averages. Each is described in more

detail below.

18

This study had five high-level steps:

For each EKPI Trucost identifies the impact ratio (the social cost or abatement cost per unit of revenue) for 532 business sectors (see Appendix 3). These are significantly higher for upstream sectors where the product is resource- or pollution-intensive and has less economic value-added (see Table 4).

For the highest-impact sectors (primary production and some primary processing) (see Appendix 3), Trucost gathered production data by country and applied country-specific impact ratios.

These results were then aggregated to the regional level.

A “Global 100” ranking was then produced to identify the top 100 externalities (EKPI by region-sector), and a “Global 20” of the top 20 region-sectors’ cumulative impacts across the six EKPIs.

Finally, Trucost’s EEIO model (see Appendix 2) was used to estimate the extent to which sectors are exposed to these upstream impacts modeled. EEIO modeling maps the flow of goods and services through an economy. By estimating and valuing the EKPIs associated with those flows, it is possible to model how a sector’s environmental impacts accumulate through the tiers of its supply chain. The Trucost model is constantly expanding and is currently based on 532 sectors. Therefore the potential number of transactions between sectors amounts to several trillion, each of which is associated with an environmental impact. The analysis identified companies that had a high combined direct and indirect (supply chain) impact, where indirect impacts were greater than direct impacts, to isolate those sectors, often consumer goods manufacturers, whose impacts are predominantly “hidden” upstream.

All values reflect 2009 production quantities (the latest year for which comprehensive data are available), product prices and environmental valuations.

TABLE 4: TOTAL DIRECT ENVIRONMENTAL DAMAGE AS A PERCENTAGE OF REVENUE FOR AN ILLUSTRATIVE SELECTION OF PRIMARY, MANUFACTURING AND TERTIARY SECTORS USING GLOBAL AVERAGES

SECTOR | TOTAL DIRECT IMPACT RATIO (NATURAL CAPITAL COST AS % OF REVENUE) |

CATTLE RANCHING AND FARMING | 710 |

WHEAT FARMING | 400 |

CEMENT MANUFACTURING | 120 |

COAL POWER GENERATION | 110 |

IRON AND STEEL MILLS | 60 |

IRON ORE MINING | 14 |

PLASTICS MATERIAL AND RESIN MANUFACTURING | 5 |

SNACK FOOD MANUFACTURING | 2 |

APPAREL KNITTING MILLS | 1 |

![]()

PROJECT METHODOLOGY

PROJECT METHODOLOGY

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 19

The specific methods used to identify the direct environmental costs and value per unit impact for each of the six EKPIs are outlined below.

LIMITATIONS OF THE APPROACH

The report provides a top-down view of global externalities by sector at the regional level. It relies on national output data from which to infer environmental impacts, as opposed to measuring all impacts from the bottom up. It does not attempt to capture intra-national differences in impacts, or differences between specific technologies and

business practices. These results could be strengthened, and the uncertainty quantified, by bottom-up analysis and use of primary data.

Furthermore, ecosystem service values derived using environmental valuation techniques contain uncertainty that is not present in the market prices of natural resources. This uncertainty may be amplified when benefits transfer techniques are applied. Finally, other than noting recent events, the study does not attempt to identify the rate of internalization of the natural capital risks estimated.

The general approaches to valuation were those applied in the PUMA Environmental Profit and Loss account (EP&L)31, with identical water and air pollution approaches. An Expert Review Panel32, including some of the world’s leading academics in this field, found that the current methodology “is appropriate to support strategic decision making, provide insight into natural capital risks faced by business, highlight potential opportunities and act as a basis to communicate a company’s impact on the environment to key stakeholders, including customers and investors”. The Panel also noted a number of limitations, especially around benefits transfer in environmental valuation, and the use of input-output modelling. The limitations and uncertainties associated with the individual EKPI methodologies are discussed below. Finally, because the aim of the report is to identify the impact “hot spots” in manufacturing supply chains, and focuses on primary production and processing, it only approximately estimates manufacturing impacts using EEIO modeling, and does not include the impacts of product use or disposal which may be material for

some sectors.

EKPIs

LAND USE

Land provides social benefits in the form of ecosystem services. When it is converted to agriculture or other industrial production, some or all of these services will be lost. The United Nations’ Millennium Ecosystem Assessment8 identified 24 services classified as provisioning, regulating, cultural or supporting. Each unit of service has a value depending on its specific location, and each ecosystem provides a different set and scale of services per unit area.

A land use factor constituting area per unit of output was calculated for each of the 532 sectors in Trucost’s model, and then valued by synthesizing and applying TEEB’s land valuation database.33 There were three steps:

PROJECT METHODOLOGY

PROJECT METHODOLOGY

A land-use factor was calculated for every sector in the model, and these were regionalized for agriculture and forestry to reflect variation in yields. Sources included The Food and Agriculture Organization of the United Nations (FAO), U.S. Geological Survey, International Energy Agency (IEA), U.S. Energy Information Administration, World Mining Congress, Independent Petroleum Association of America, U.S. Census Bureau, Office for National Statistics and company disclosures. For sectors with high impacts (such as agriculture, forestry and mining), these factors were then multiplied by production in each country to calculate the area of land used in each

country-sector.

To calculate the value of each unit of land area, the study relied on TEEB’s database to derive a global median value for each of the 26 ecosystems from over 1,100 individual valuations. The valuations were converted to current prices using local inflation rates, and then to US$ using 2009 exchange rates. The median was identified to exclude outliers. Land values depend on the ecosystem services provided, and the demand for them.

20

Ecosystem services depend on local factors such as biodiversity and geophysical properties. Demand depends on factors such as population density, purchasing power and geophysical factors. Initially an average of the global median marginal values was calculated for each sector, weighted according to the ecosystem distribution of that sector’s activities. Global ecosystem distribution was measured using the Terrestrial Ecosystems of the World geographic information system (GIS) file.34 Trucost overlaid data from a GIS file of crop distributions for crop distribution, and used natural forest distribution for forests.35 Where the ecosystem distribution was not known, a simple average was used, although this was only necessary for lower impact sectors.

An area of land was only considered “used” if it had been disturbed. For example, rather than using mining concession areas, disturbed areas were estimated from company disclosures. For all sectors other than forestry, the loss of ecosystem services was assumed to be 100% when land was used. For forestry the land goes through a cycle of deforestation-afforestation-deforestation etc. This means that the benefits provided by the ecosystem in each cycle vary between zero and close to 100% depending on the specific service. The situation is complex and will depend on the specific forestry practices and the virgin ecosystem, but for the purposes of this study it is assumed that on average 40% of the ecosystem services were maintained over time. Logging of virgin forest was assumed to result in total loss of ecosystem services.

The values in the database reflect the marginal ecosystem services used. For each sector these were adjusted to reflect the fact that the current value of the marginal land converted is higher than the average value (in current prices) since the first part of an ecosystem was converted from its virgin state. This is because the supply of ecosystem services has declined. Unlike water use and emissions pollution, conversion of land has occurred over a long period of time, and therefore the theoretical risk and responsibility to business will, on average reflect the mean rather than the

marginal value.

The relationship between ecosystem service scarcity and value may be exponential in the case of some services in some locations, but in light of a lack of conclusive data, a linear relationship has been assumed. This means that the average value is estimated to be half the current marginal value.36 This average value was applied to the total land area used by each country-sector (identified in step 1) to develop a list of the highest impact country-sectors.

These impacts were adjusted to reflect any differences between countries in the value of the same ecosystem due to local specificities. For example, “Temperate Forests General” in North America has a median value of US$250 per

hectare per year while the same ecosystem in East Asia has a median value of US$552 per hectare per year. From the list of country-sectors with the highest land use impact by value identified in step 2, in this step the TEEB database was revisited to identify specific studies relating to the ecosystems used by each of the top 20 country-sectors. For example, we were able to identify 24 values specific to the ecosystems being used by the soybean farming sector

in Brazil.

The country-values (both global median and country specific) were then aggregated to the regional level, to develop a list of the top 20 region-sector land use impacts.

PROJECT METHODOLOGY

PROJECT METHODOLOGY

Ocean ecosystems were not included in the modeling exercise described above as the impact on the oceans and freshwater bodies is generally captured by the other impacts, rather than direct use. As mentioned previously, catastrophic events such as oil spills do not form part of this report’s analysis and the impact of over-fishing is estimated separately based on the economic loss of over-fishing identified by the World Bank and the FAO, adjusted to 2009 prices.37

The principal limitations and possible errors that may arise through this approach to land use valuation are:

Methods and assumptions are not standardized across studies, and individual valuation studies do not contain a complete set of relevant ecosystem services in some cases.

Ecosystem service functions and values are highly localized and transfer at the national level will increase the level of uncertainty present in underlying values.

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 21

The assumption that there is a linear relationship between ecosystem service values and scarcity, and that all ecosystem services are lost regardless of the type of industrial activity, probably overstates the mean value, especially in regions such as Europe, where conversion occurred a long time ago.

There may be double counting with water ecosystem service values identified below, although efforts were made to limit this.

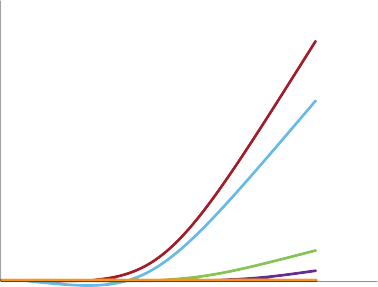

WATER CONSUMPTION

Water that is directly abstracted from surface or groundwater is rarely paid for. However it has a substantial value to society which varies according to its scarcity. As with land use, water consumption differs per unit of output depending on the location, especially in agriculture, which is responsible for the vast majority of global water use.

The other major consumer of abstracted (as opposed to purchased) water is the water supply sector, which again has regional differences in terms of recycling rate and distribution losses. Apart from these two sectors, there was no

regional differentiation in the rate of water use per unit of output, which depends on other factors such as technology or, in the case of mining, ore grade.

Irrigation rates by agricultural country-sector were taken from Mekonnen and Hoekstra24 data. Water distribution and distribution losses were collected from sources including The International Benchmarking Network for Water and Sanitation Utilities, Global Water Intelligence, Ecoinvent, Carbon Disclosure Project, European Commission, various academic studies and company disclosures.

Having identified the rate of net abstracted water consumption per unit of output for each country-sector, this was multiplied by the sector output in each country to give an estimate of total water consumption. A country-specific value was then applied to each unit of water consumption.

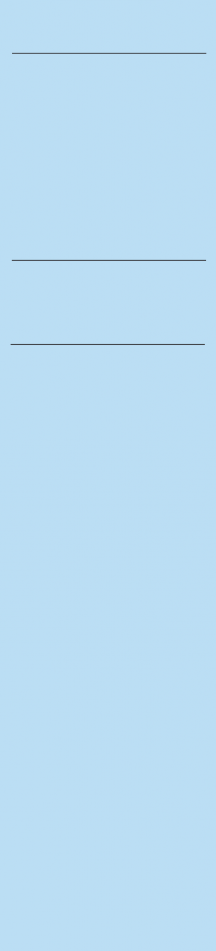

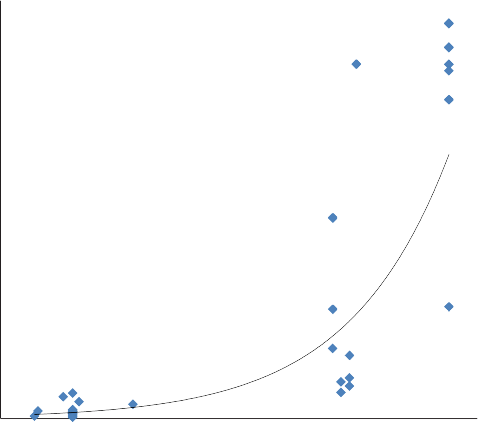

According to the “Total Economic Value” (TEV) framework38, the value of water can be broken down into “use” values and “non-use” values (see Figure 2). Use values can be further broken down into direct use, indirect use, and option values, and within direct use, the values can apply to “consumptive” or “non-consumptive” uses. The “cost” of water consumption is the change in the TEV, and since it is not known whether a change in the industrial application of direct consumptive use would increase or decrease the value, this is excluded. Option and non-use values were also excluded, given the difficulty of valuing these. Therefore direct non-consumptive use and indirect use values were estimated. Specifically, values for recreation, biodiversity, groundwater recharge, and other benefits including navigation were identified in academic literature in different locations (example studies are referenced39,40,41), and the water scarcity in each location estimated using the FAO Aquastat database42. Values were adjusted to reflect 2009 prices, and comprised both marginal and average values. Monetary values are applied per cubic metre (m3) of water.

PROJECT METHODOLOGY

PROJECT METHODOLOGY

22

FIGURE 2: COMPONENTS OF THE TOTAL ECONOMIC VALUE OF WATER

A function of water value (in US$ per m3) relative to water scarcity (% of internal renewable water resource abstracted) was then developed based on the value of the benefits identified above, in US$ prices. This function was then used to estimate the social cost of water in any location where the scarcity is known, by adjusting the function estimate for purchasing power parity at that location.

The value derived for each country was then multiplied by the total water use by country-sector to calculate the social cost of water consumption by country-sector. These values were then aggregated to develop a ranking of the top 20 water consuming region-sectors in terms of social cost.

The principal limitations and possible errors that may arise through this approach to water consumption valuation are:

Non-use and option values which may be significant are excluded.

PROJECT METHODOLOGY

PROJECT METHODOLOGY

The benefits transfer approach used here assumes that the benefits vary due to supply (water scarcity) rather than demand for the services water provides, and water scarcity has been measured at the national rather than river basin level in this instance.

Methods and assumptions are not standardized across studies.

Values identified in the literature are a mixture of marginal and average values.

There may be double counting with land-use ecosystem service values identified in this study, although efforts were made to ensure this was not the case.

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 23

GREENHOUSE GASES

The impacts of climate change are estimated to include reduced crop yields, flooding, disease, acidification of oceans and loss of biodiversity. The timing, magnitude and economic and social cost of these are modeled under scenarios, and linked to concentrations of carbon dioxide in the atmosphere. From that, the marginal cost of each metric ton of carbon dioxide or other GHG is adjusted for its global warming potential.

The level of GHG emissions per unit of output across the 532 sectors has been derived from Trucost’s database of company disclosures and organizations such as the IEA, United Nations Framework Convention on Climate Change, Intergovernmental Panel on Climate Change, European Commission, U.S. Department of Energy, Ecoinvent, European Environment Agency, United States Environment Protection Agency (EPA), Asian Institute of Technology and academic literature. Total emissions are based on emissions of seven individual gases which are converted to carbon dioxide equivalents (CO2e). These emissions factors were then multiplied by the level of output to estimate the total level of CO2e emissions for each country-sector.

A social cost of US$106 per metric ton of CO2e was used, which is the value identified in the UK Government’s Stern report9 as the central, business-as-usual scenario, adjusted for inflation to 2009 prices using a global weighted average consumer price index (CPI). This value was multiplied by the country-sector GHG emissions to calculate the GHG impacts in monetary terms. The country-sector impacts were aggregated to create a ranking of the top 20 region-sectors with the highest GHG impacts. The uncertainty surrounding the estimation and valuation of climate change impacts is wide ranging and is covered in depth in the Stern Review.9

AIR POLLUTION

Air pollutants include sulfur dioxide (SO2), nitrogen oxides (NOx), particulate matter (PM), ammonia (NH3) carbon monoxide (CO) and volatile organic compounds. Each has a set of impacts on human health and/or crop and forest yields. The economic damage caused per unit of pollutant depends on the specific location, and is driven by population and crop and forest density.

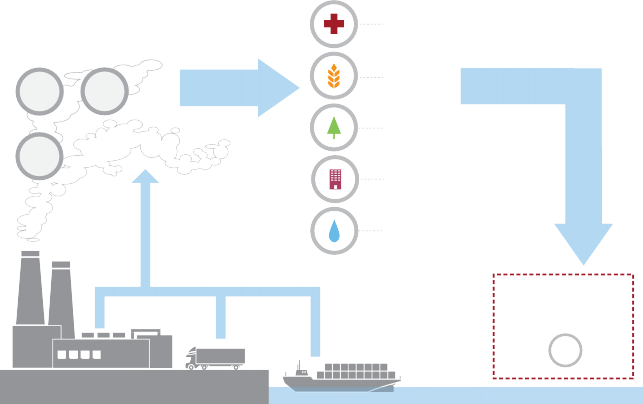

Studies of damage costs of air pollution use Impact Pathway Analysis (IPA) to follow the analysis from identification of burdens (e.g. emissions) through to impact assessment and then valuation in monetary terms.43 These studies translate exposures into physical effects using dose–response functions (DRFs). The relationships embodied in the DRFs are established in peer-reviewed studies. The IPA (see Figure 3) measures the relationship between a unit concentration of a pollutant (dose) and its impact on an affected receptor (population, crops, buildings, water, etc.) based on scientific data, and then assigns a financial value to those impacts.

FIGURE 3: IMPACT PATHWAY ANALYSIS

PROJECT METHODOLOGY

PROJECT METHODOLOGY

Adapted from EXIOPOL (2009)44

In this study the six air pollutant emissions were estimated by sector and were derived principally from the United States Toxic Release Inventory, European Pollutant Release and Transfer Register, Australia’s National Pollution Inventory, Canada’s National Pollutant Release Inventory and Japan’s Pollutant Release and Transfer Register supplemented by other datasets such as Ecoinvent where necessary. This data was then mapped to sector output to generate emissions factors, which were assumed to be consistent globally for each sector. Emissions factors for each pollutant were then multiplied by output to calculate the quantity of air pollution to which costs could be applied.

24

Five impacts are included in the valuation: negative health effects, reduced crop yields, corrosion of materials, effects on timber, and acidification of waterways. All studies have found that health costs dominate the total cost of air pollution (see Figure 4). The U.S. Environmental Protection Agency (EPA)45 and European Commission found that the most significant known human health effects from exposure to air pollution are associated with fine particles and

46

46

ground-level ozone (O3) pollution, which are therefore of most concern.

Nitrogen oxides can contribute to

particulate matter and react with volatile organic compounds to form ground-level ozone, while sulfur dioxide can result in particulate matter and sulfuric acid deposition (acid rain). Particulate matter can damage respiratory systems and cause premature death.47

To estimate the receptor densities, population48, forest49 and crop densities50 were calculated at a national level. Dose response functions were taken from academic literature. Health impacts were valued according to the value of a statistical life (VSL), and a function of VSL relative to incomes was developed from 37 studies conducted in 11 countries (example studies are referenced51,52,53).

FIGURE 4: AIR POLLUTION VALUATION

![]()

![]()

![]()

VOCs CO

PM10

HEALTH

NOx

NH3

CROPS

IMPACTS VALUATION

SO2

TIMBER

CORROSION

WATER ACIDIFICATION

COSTS PER TON

$

PROJECT METHODOLOGY

PROJECT METHODOLOGY

The main limitations and uncertainties with this approach to valuing air pollution impacts are:

Although the impact on human health has been shown to dominate air pollution impacts, the limitation of impacts to the five categories may underestimate the true extent of the damage.

Differences in ambient air pollution levels, which are not considered here, will cause average values to vary between locations even where all other factors are the same.

The study did not consider varied dispersion of air pollutants and the use of national data may not be representative of the range of effects.

![]()

TRUCOST PLC NATURAL CAPITAL AT RISK: THE TOP 100 EXTERNALITIES OF BUSINESS 25

Local emissions factors may vary significantly from global averages, especially in developing countries.